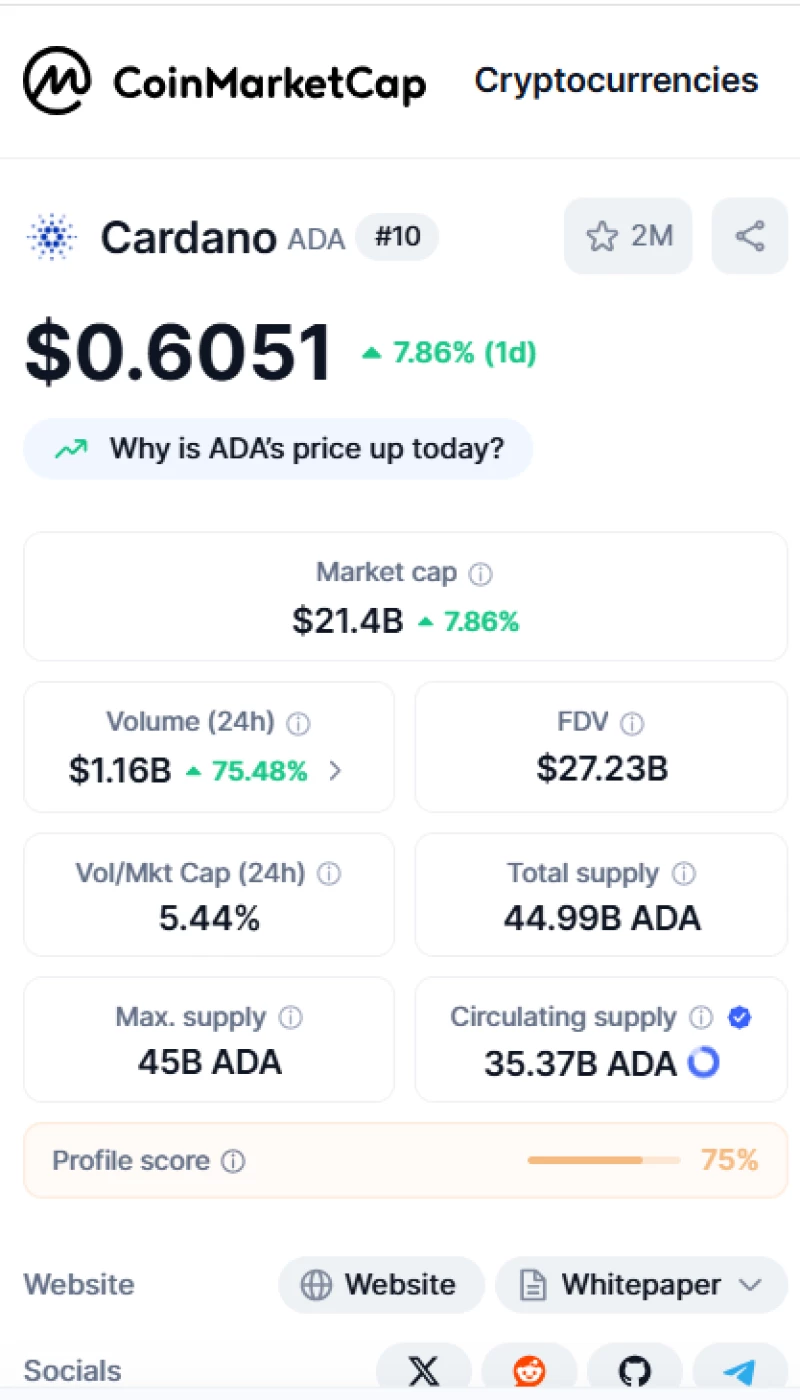

Thursday turned into a bloodbath for crypto shorts, and Cardano (ADA) was right in the middle of the action. The tenth-largest crypto by market cap saw its 24-hour trading volume jump 75% to hit $1.15 billion, according to CoinMarketCap. This wasn't just random trading - it was driven by a massive short squeeze that wiped out $284 million in bearish bets across the entire crypto market.

The numbers tell the story pretty clearly. CoinGlass data shows total liquidations reached $352 million, with shorts making up 80% of that carnage. When you've got that many over-leveraged bears getting forced out of their positions, prices tend to move up fast. Bitcoin hit a three-week high, and altcoins like ADA caught the wave.

ADA Price Breaks Out After Weeks of Struggle

Cardano didn't just see volume - the price actually moved too. ADA climbed nearly 8% in 24 hours to reach $0.601, bouncing hard from Wednesday's low of $0.538. The token hit an intraday high of $0.611, which is its best level since June 19th.

What's interesting here is that ADA has been stuck in a rut for weeks, so this move feels different. The volume surge suggests real interest, not just technical buying from liquidations. When shorts get squeezed this hard, it creates a feedback loop - forced buying pushes prices up, which forces more shorts to cover, and so on.

The hourly chart is showing a golden cross formation, which is basically when short-term momentum crosses above longer-term trends. Traders like to see this as confirmation that the bullish move has legs.

What's Next for Cardano (ADA)?

Looking ahead, ADA has some clear levels to watch. If buyers can push above $0.61, the next target is the 50-day moving average at $0.663. Break above that, and we're looking at the 200-day MA around $0.765. Getting above both those levels would signal a real trend change.

But here's the thing - crypto moves both ways. If ADA fails here and drops below $0.54, things could get ugly fast. The key support to watch is $0.50, because losing that level would complete a descending triangle pattern. That's trader-speak for "prices could fall to $0.40."

Cardano just had its best day in weeks, driven by a short squeeze that caught a lot of people off guard. Whether this momentum continues depends on whether buyers can defend the current levels and push higher. The volume spike shows there's definitely interest, but in crypto, today's hero can be tomorrow's zero pretty quickly.

Peter Smith

Peter Smith

Peter Smith

Peter Smith