Cardano's impressive 23% weekly rally has traders excited, but smart money might be heading for the exits. Here's why ADA's latest pump could turn into a dump.

ADA just had its best week in months, jumping 23% and adding another 3.52% today alone. But before you FOMO in, there are some serious warning signs that suggest this party might be coming to an end.

ADA Price Rally: Too Much Too Fast?

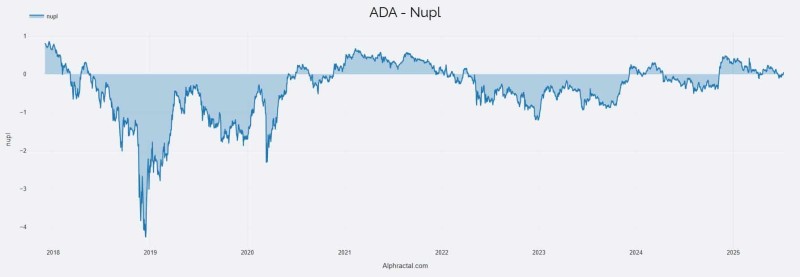

When everyone's making money, that's usually when things get messy. Right now, Cardano's Net Unrealized Profit and Loss (NUPL) is way above zero, meaning most ADA holders are sitting pretty with profits. Sounds good, right? Not really.

Here's the thing - when too many people are in profit, they start selling. It's human nature. And that selling pressure can quickly turn a rally into a crash. We've seen this movie before with other cryptos, and it rarely ends well for late buyers.

Analyst Joao Wedson from Alphractal isn't buying the hype either. He's calling for a "short-term cooling period" before ADA potentially hits $3 later this year. His selling target? $4.90. That tells you everything about where he thinks this is headed in the short term.

Mixed Signals in ADA's On-Chain Data

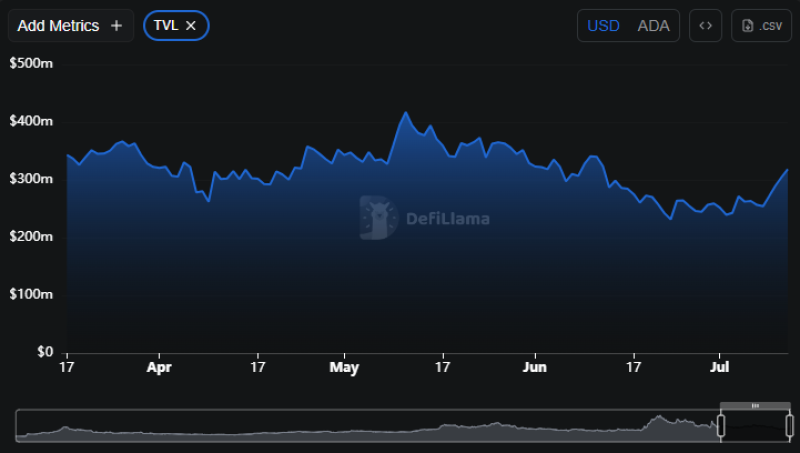

The data's telling two different stories right now. On one hand, Cardano's Total Value Locked (TVL) jumped 3.44% to $313.75 million in just 24 hours. That usually means people are confident enough to lock up their tokens for rewards - pretty bullish stuff.

But here's the kicker: $280,000 worth of ADA just left exchanges. That's the first major outflow after days of people buying. Now, this could mean investors are moving coins to cold storage for safekeeping, or they're getting ready to sell without crashing the price.

The derivatives market is even more confusing. Both long and short positions got liquidated equally - about $4.9 million each way. When the market can't decide if it wants to go up or down, that's usually when volatility hits hard.

What's Next for ADA Price?

Despite all the warning signs, bulls still have some ammo. Recent trading shows buyers made up 76.22% of volume while sellers only hit 23.78%. That's still pretty bullish, but it could change fast if sentiment shifts.

The problem is, we're in that danger zone where ADA looks overbought. Smart money often uses these moments to dump their bags on retail investors who are just catching on to the rally. If that happens, all those buyers at current levels could get burned pretty badly.

Look, Cardano's got solid long-term potential with all the development happening in the ecosystem. But short-term? This feels like one of those "buy the rumor, sell the news" moments. The 23% rally brought in the FOMO crowd, but the smart money might already be planning their exit strategy.

If you're holding ADA, maybe consider taking some profits off the table. If you're thinking about buying, wait for a pullback. This market's about to get interesting.

Usman Salis

Usman Salis

Usman Salis

Usman Salis