Cardano (ADA) is struggling with heavy selling pressure and dropping development activity, making it tough for the price to bounce back anytime soon. The crypto has been sliding since late May, even after some decent gains earlier in the year.

Cardano (ADA) Bulls Have Gone Quiet Since Market Structure Flipped

Things haven't been great for Cardano holders lately. The coin's been on a downward slide since late May, which is pretty frustrating considering how it started the year. When Bitcoin went on its tear from $76k all the way up to $111.6k back in April and early May, Cardano managed to tag along for the ride with a solid 46% pump.

But here's the thing - that rally only got ADA back to where it was sitting at the bottom of a six-month trading range. Not exactly the breakout everyone was hoping for, right? Since then, it's been pretty much downhill, and frankly, it's got a lot of people worried.

The technical picture isn't helping either. On May 30th, Cardano broke below that key $0.71 level, and that's when things really started to look sketchy. According to AMBCrypto's analysis, traders should probably keep their bearish hats on because this doesn't look like it's turning around anytime soon.

Profit-Takers Are Ready to Dump on Any Cardano (ADA) Rally

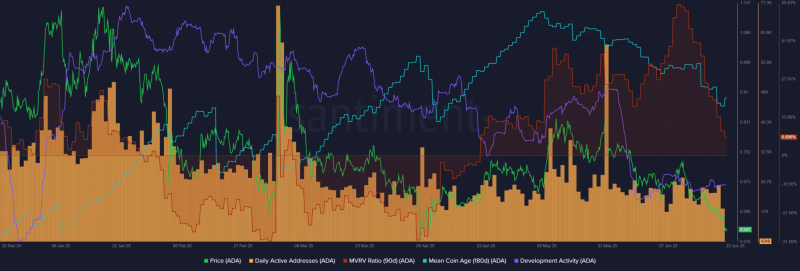

Now here's the kicker - the 90-day MVRV ratio has been positive for almost two months now. That happened after Cardano bounced back from $0.57 in April and shot up to $0.8 by mid-May. Even that quick move from $0.65 to $0.72 we saw recently pushed this metric higher.

What this tells us is that anyone who bought ADA in the last three months is basically sitting on profits, even after all the recent selling. Sounds good, right? Well, not really. Here's why this is actually a problem: these profitable holders are just waiting for any decent bounce to cash out.

The share of holders in profit has been dropping fast, which means the moment ADA tries to rally, these guys are going to hit the sell button. It's like having a ceiling over your head - every time the price tries to move up, boom, more selling pressure kicks in.

Looking at the charts, it's pretty clear that sellers are in control right now. The next stop looks like $0.51, and if that level breaks, we could see ADA test the $0.427 support. That would open up some short-selling opportunities for the bears.

Bottom line? Any recovery for Cardano is going to be an uphill battle. Sure, we might see some range-bound trading that could signal a bottom is forming, but that would need to come with some serious buying interest and a change in the distribution pattern. Until that happens, it looks like ADA is going to keep struggling under the weight of all this selling pressure.

Usman Salis

Usman Salis

Usman Salis

Usman Salis