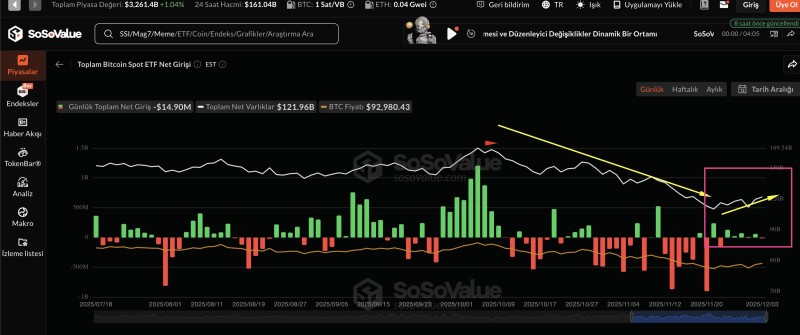

⬤ Bitcoin Spot ETFs just made a noticeable shift this week, pulling in fresh capital after three weeks straight of money flowing out. The turnaround ends a stretch that had been weighing on sentiment around BTC. The charts show the switch from red outflow bars to green inflows, matching up with steadier total assets. BTC was sitting around $92,980 when this data came through.

⬤ The visual breakdown tells a clear story. After weeks of heavier exits, a pattern of steady inflows started showing up in the pink-highlighted section. The white line tracking total ETF assets turned upward, breaking away from the earlier downtrend marked by the yellow line. While these new inflows aren't as strong as what we saw during earlier accumulation phases, the consistent return to positive numbers shows ETF activity is picking back up.

⬤ Looking back at the chart, late summer and early fall brought some serious inflows before things took a dive through most of November. That downward slide, shown by the yellow trendline, lines up with the extended withdrawal period. But the most recent bars show a better balance, meaning the pressure from all those withdrawals has let up. Moving from deep red bars to smaller green ones shows real improvement in ETF participation while BTC holds in a high-value range.

⬤ This matters because ETF flows give us a solid read on market liquidity and overall confidence. Going from weeks of outflows to regular inflows again signals that sentiment is strengthening. As Bitcoin Spot ETFs get back into accumulation mode, this shift in fund behavior adds important context for where the digital asset market might be heading next.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets