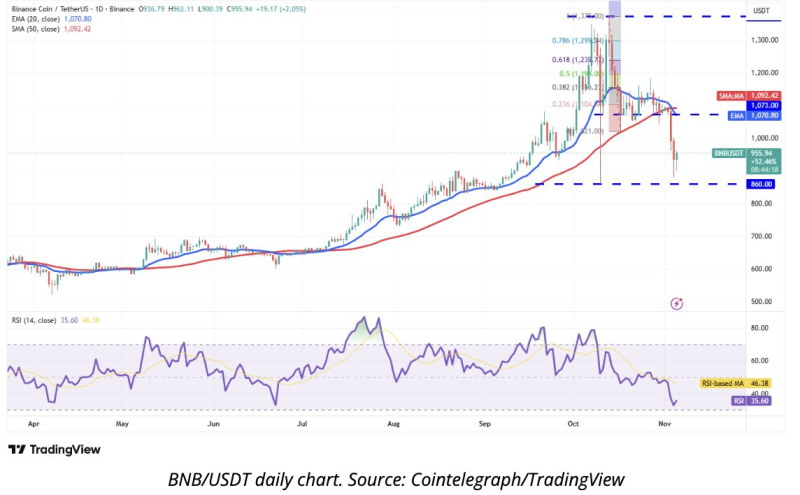

● According to Mr. CryptoCeek, BNB has fallen below the key $1,021 mark, confirming a short-term top. After a strong run earlier this quarter, the token is now correcting and trading below its 20-day EMA ($1,070) and 50-day SMA ($1,092)—both bearish signs showing weakening momentum.

● The main focus is the $860 support level. If it breaks, analysts expect a deeper drop toward the mid-$700s, which could trigger more liquidations and hurt sentiment. But if BNB bounces above $1,070, it could invalidate the breakdown and target $1,200 again.

● BNB's weakness impacts the entire Binance ecosystem—affecting fees, staking, and DeFi liquidity. Prolonged decline could reduce yields and cause temporary outflows from BNB Chain. Still, renewed buzz around CZ's recent activity might help restore confidence if Binance's fundamentals stay strong.

● The correction mirrors a broader cooldown across altcoins as Bitcoin stabilizes. With RSI at 35.6, BNB is nearing oversold territory, hinting at a possible relief rally if buyers hold $860. Traders are watching closely to see if this is the bottom or just a breather before another leg down.

$BNB slid under $1,021—short-term top confirmed. Support sits around $860, but bulls might push for a range between $860–$1,070. Will CZ's comeback vibes fuel a recovery or are we not done dipping yet? As Mr. CryptoCeek noted

● With technicals weakening but sentiment cautiously improving, BNB is at a turning point that could shape its next major move.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi