Bitcoin (BTC) rebounds with a 25% increase, crossing $62,000 and reigniting investor optimism in the crypto market.

Bitcoin Regains Strength After a Dark Period

In the past two weeks, Bitcoin has witnessed a remarkable recovery, surging by 25%. This uptick has renewed investor enthusiasm as digital assets gain value, signaling a potential turnaround for the crypto market.

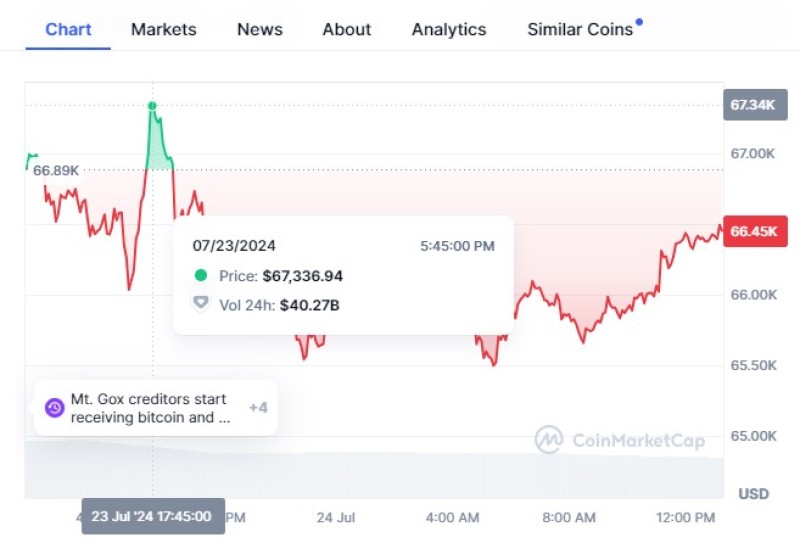

Bitcoin's resurgence is notable as it crosses the $62,000 mark, overcoming significant hurdles. Bitcoin first surpassed the 200-day moving average, marking the initial sign of recovery. Following this, breaking the $59,500 level further confirmed the upward trend, driven by increasing trading volumes and shifting investor sentiment from anxious to cautiously optimistic.

BTC and Other Cryptos on the Rise

The positive momentum is not limited to Bitcoin alone. Solana (SOL) has also experienced a significant recovery, rising from $111 to approximately $177. This broad-based recovery in the crypto market is accompanied by a rise in crypto application downloads and capital inflows into Bitcoin ETFs, indicating a transition from a weak to a strong market phase.

Despite Bitcoin nearing its historical peak of $67,500. The market is expected to grow steadily after a four-month correction, with investor enthusiasm gradually returning. It also highlights the significant impact of ETF news on the crypto market, with the recent launch of Ether funds fueling investor interest. Some analysts, like Matt Hougan of Bitwise, predict that these developments could push ETH prices above $5,000, potentially overshadowing Bitcoin ETFs.

Conclusion

The current positive trend extends beyond major cryptocurrencies. Various altcoins are showing signs of recovery, presenting new investment opportunities for traders. As the crypto market enters a new dynamic phase, BTC strength above $62,000 is a promising sign. However, investors must remain cautious due to the inherent volatility of the sector. Bitvavo's sharp analyses continue to provide valuable insights, helping investors navigate the evolving crypto ecosystem.

Usman Salis

Usman Salis

Usman Salis

Usman Salis