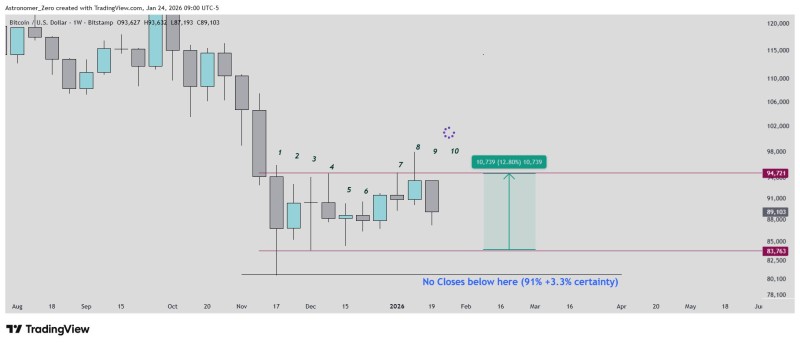

⬤ Bitcoin remains locked in a narrow consolidation pattern on the weekly chart, holding its key support zone for nine straight weeks with the tenth week now forming. Despite sustained downside pressure, BTC hasn't broken below the established bottom around $83,763, showing that sellers haven't been able to push price lower even as bearish sentiment persists.

⬤ The current range sits between $83,763 on the low end and $94,721 at the top, with BTC hovering near $89,000 in the middle. Weekly candles keep testing the lower boundary but haven't managed to close below it, showing how compressed the volatility has become. The price action suggests accumulation rather than distribution, with neither buyers nor sellers gaining clear control.

⬤ Technical projections point to a potential 12% upside move from the range bottom to the top. "The longer price holds within this structure, the higher the probability of the bottom remaining intact," based on how similar consolidation patterns have played out historically. What's notable is that despite widespread expectations of deeper drops, the chart shows zero structural breakdown—price is compressing, not collapsing.

⬤ This extended consolidation matters because it's happening at relatively high levels, which could shift broader market positioning if the support continues holding. Each week that passes without a breakdown adds weight to the range and may force bearish traders to reconsider their positions. Whether this tight structure resolves with a breakout higher or eventually gives way to renewed selling pressure remains the key question for Bitcoin's next move.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov