⬤ Bitcoin's hitting a rough patch as global trade worries make a comeback. With tariff tensions heating up again, investors are getting nervous and pulling back from riskier bets—and crypto's feeling the heat. The price action tells the story pretty clearly: whenever trade disputes flare up, Bitcoin tends to follow the broader risk-off mood across markets.

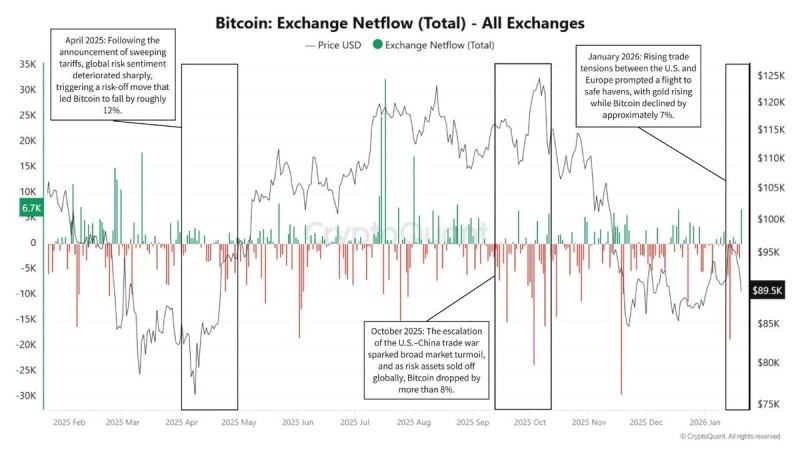

⬤ Looking at exchange flow numbers gives us a clearer picture of what's driving this pullback. When more Bitcoin starts flowing into exchanges, prices typically drop—it's a telltale sign that holders are preparing to sell. Back in April 2025, after major tariff announcements hit the wires, Bitcoin tumbled about 12%. Exchange inflows spiked during that period, showing investors were actively reducing their exposure as economic uncertainty ramped up.

⬤ We saw the same playbook in October 2025 when U.S.–China tensions escalated. Bitcoin dropped over 8% as risk assets got hammered globally. Then in January 2026, U.S.–Europe trade friction pushed investors toward traditional safe havens—gold rallied while Bitcoin slid roughly 7%, with exchange activity again reflecting the shift away from risk.

⬤ What matters here is that Bitcoin's proving more sensitive to macro headlines than many expected. This isn't about crypto-specific news anymore—it's about how quickly capital moves when geopolitical uncertainty spikes. The connection between exchange flows and price drops during these episodes shows that macro stress events are still calling the shots for Bitcoin's short-term moves.

Peter Smith

Peter Smith

Peter Smith

Peter Smith