Bitcoin's Price Overview

This week was rich in events. Donald Trump unexpectedly ended negotiations on a new economic reward plan, which led to a drop in the value of risky assets. Bitcoin, however, managed to maintain its value once again and, despite the report that Square bought $50 million in BTC on October 8, actually skyrocketed.

When the price broke out of the downward upper trend and stepped into the $11,000–$12,000 zone, as indicated in the OKEx BTC spot prices, Bitcoin posted a weekly increase of 6.29 percent. In total, from last year's $ 347 billion, the capitalization of the cryptocurrency increased to $366 billion.

Because of the rally last week caused by the news from Square in the second half of the week, institutional investors were restrained from positioning themselves early. After the Bitcoin increase to $11,000, we will continue to watch how institutional investors react.

Fundamental Price Factors

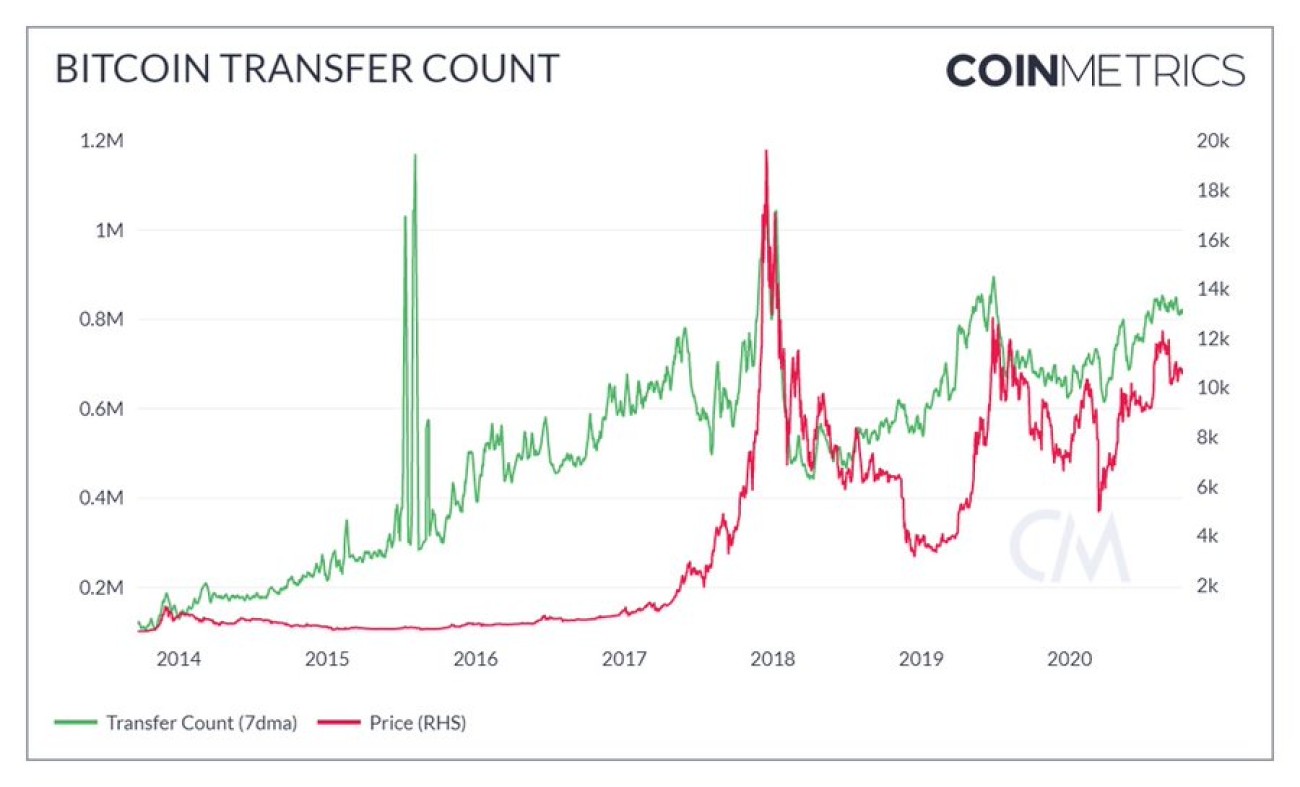

On-chain data, the average 7-day amount of Bitcoin network transactions increases as the price increases. These data show that the network is secure and its consumers are actively using it.

It also confirms that the latest cryptocurrency price rise is endogenous and healthy, providing confidence that annual peaks can be modified.

The highest acceptance rate, the average of BTC 30 days, is around $ 15,000, which reveals that the highest cryptocurrencies at present prices are significantly undervalued at around $ 11,000.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov