Joe Biden's exit from the 2024 presidential race led to $67 million in crypto liquidations within 30 minutes, heavily impacting BTC and ETH prices.

Biden’s Withdrawal Causes Crypto Market Shock

US President Joe Biden’s decision to withdraw from the 2024 presidential election race resulted in a sharp decline in the cryptocurrency market, leading to massive liquidations. Within just 30 minutes, nearly $67 million in leveraged long positions were wiped out.

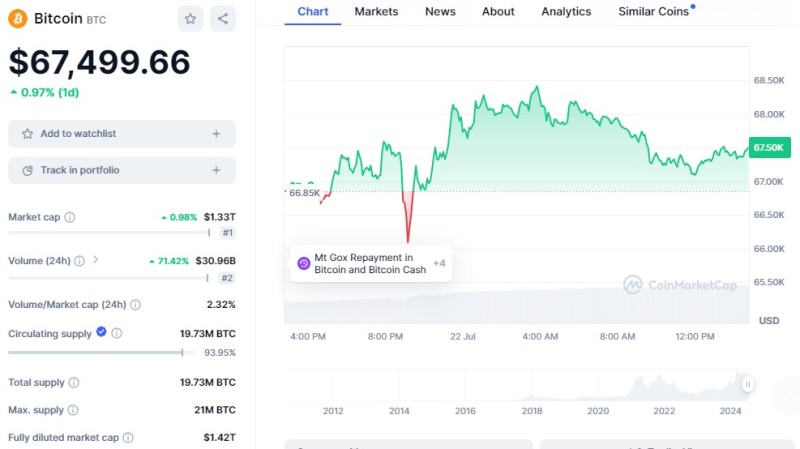

Between 5:30 pm and 6:00 pm UTC on July 21, Bitcoin (BTC) experienced a sudden 2.3% drop, falling from $67,385 to $65,880. This swift decline triggered the liquidation of $67 million in long positions. However, Bitcoin quickly rebounded, reaching a 24-hour high of $68,499, resulting in $34 million in losses for traders holding short positions.

Expert Insights on Market Movements

Markus Thielen, founder of 10x Research, commented:

Thielen also noted that a significant buy order contributed to Bitcoin’s sharp recovery during this period.

Over a 12-hour window from 10:00 am to 10:00 pm on July 21, the market saw more extensive liquidations. Over $81.1 million in long positions and $53.4 million in short positions were liquidated. Bitcoin (BTC) accounted for $43.8 million of these liquidations, while Ether (ETH) saw $31.1 million wiped out. Solana (SOL) also faced significant liquidations amounting to $8.6 million.

Highest Liquidations Since July 8

The total liquidations of $134.5 million over the 12-hour period marked the highest since July 8. Most of these liquidations occurred on Binance and OKX, with $64.5 million and $44 million respectively.

With Joe Biden out of the race, US Vice President Kamala Harris is considered a likely candidate for the Democratic Party’s presidential nomination. The crypto market’s reaction to these political developments underscores the interconnectedness of global events and digital asset prices.

In conclusion, at the time of publication, Bitcoin is trading at $67,850, up 0.55% over the past 24 hours, reflecting ongoing volatility and investor sentiment in the wake of significant political news.

Peter Smith

Peter Smith

Peter Smith

Peter Smith