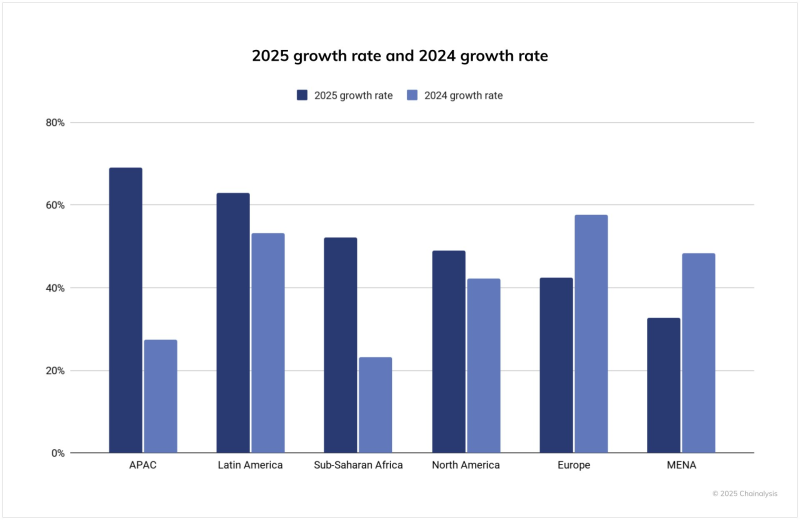

● According to a recent post from Coin Bureau, the Asia-Pacific region has pulled ahead as the hottest spot for crypto adoption globally. On-chain activity grew 69% year-over-year, with transaction volume nearly doubling from $1.4 trillion to $2.36 trillion. The growth is mainly coming from India, Vietnam, and Pakistan.

● This boom puts APAC at the center of crypto's next chapter, but it's also creating some headaches for regulators. They're trying to figure out how to encourage innovation without losing control. Tax policies that are too harsh or unclear could push startups to friendlier countries and scare off institutional investors. On the flip side, clear rules—like India's framework for classifying and taxing crypto—could actually strengthen local markets while reducing risks like fraud and money leaving the country.

● The spike in transactions represents billions in potential tax revenue. Crypto isn't just speculation anymore—people are using it for payments, sending money home, and accessing DeFi platforms. More governments in the region are considering taxing profits instead of transactions, which could bring in steady revenue without killing innovation.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah