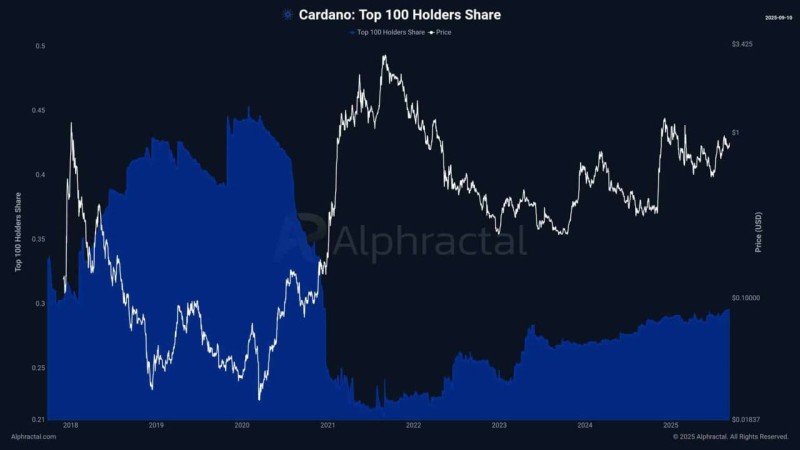

Something's happening behind the scenes with Cardano. The biggest ADA holders are quietly grabbing more tokens, and it's starting to show up in the data. The top 100 wallets have been steadily increasing their slice of the pie over recent months, which usually means these big players see something the rest of us might be missing. Meanwhile, short-term holders are stepping back, creating less selling pressure in the market.

What the Numbers Show

As Kamil points out, this kind of setup often leads to bigger moves in crypto.

The charts tell a clear story:

- Whale accumulation is accelerating: After months of staying flat, the top 100 wallets now control more ADA than before

- Price stability around $1: While other cryptos have been swinging wildly, ADA has been holding steady near the dollar mark

- Historical patterns: We've seen this movie before - similar whale buying in 2020-2021 preceded ADA's run to over $3

Why This Actually Matters

When the big money starts accumulating, it creates a different market dynamic. Fewer tokens are available for quick selling, which means any new buying pressure could push prices higher faster than usual. Add in the growing interest in proof-of-stake networks and blockchain adoption, and ADA might be setting up for something significant.

This whale accumulation trend suggests growing confidence in Cardano's future. If the big holders keep buying and short-term supply keeps shrinking, ADA could face much less resistance on its way up. Smart money is positioning itself, and that's usually not a coincidence. Keep watching those whale movements and key resistance levels - they'll likely give us the best clues about when ADA might make its next big move.

Usman Salis

Usman Salis

Usman Salis

Usman Salis