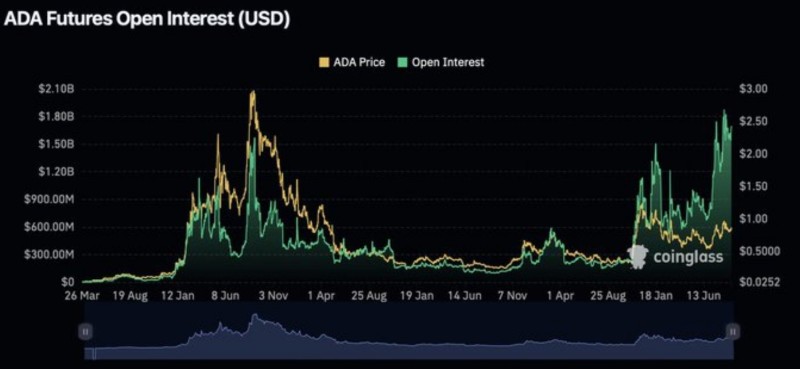

Something big is brewing with Cardano. ADA futures open interest just smashed through $2.5 billion according to trader data, marking the highest level in nearly four years. This isn't just another pump - it's serious money positioning for what could be ADA's next major breakout. The last time we saw numbers like this, Cardano was heading toward its $3 all-time high.

The spike didn't happen in a vacuum. Here's what's really moving the needle:

- Altcoin rotation fever: Big money is flowing out of Bitcoin and Ethereum into promising altcoins like ADA

- Ecosystem momentum: Cardano keeps pulling in developers and DeFi projects after its recent upgrades

- FOMO positioning: The leverage buildup screams that traders expect a major price move

The Chart Tells the Story

ADA's open interest chart perfectly mirrors what's happening with price action. We've gone from under $1 billion in OI earlier this year straight up to $2.5 billion. Meanwhile, ADA's price has been climbing alongside, recently testing the $2.50 zone. This parallel movement between derivatives activity and spot price is textbook bullish momentum - but it also means we're sitting on a powder keg of leverage that could explode either way.

What Happens Next

The technical setup is crystal clear. ADA needs to break above $2.50 resistance to unlock a potential run toward $3.00. If it fails, $2.00 support becomes the line in the sand. But here's the thing about extreme leverage - it amplifies everything. A breakout could send ADA flying back toward its all-time highs, while a breakdown could trigger massive liquidations.

Usman Salis

Usman Salis

Usman Salis

Usman Salis