The DeFi giant's token jumped from $213 to $267 – hitting a three-month high while most of crypto sees red.

AAVE Token Soars as Market Shrugs

In a stunning reversal of fortune, Aave's governance token has absolutely crushed it today, surging 25% in under 24 hours. While most crypto traders are nursing their wounds amid a broader market dip, AAVE holders are popping champagne as the token catapulted from $213 to a hefty $267 by May 20th.

The crypto, which powers one of DeFi's oldest and most respected protocols, has left everything else in the dust, claiming the top spot among the 100 biggest cryptocurrencies. Talk about swimming against the current – the rest of the market tanked 1.5% overnight, with even Bitcoin barely managing a measly 0.3% gain.

Is the GENIUS Act Fueling AAVE's Remarkable Run?

Crypto Twitter is buzzing with theories about what's behind this massive pump, with many pointing to the GENIUS Act gaining serious traction in Washington. The bill could be a game-changer for the industry, potentially taking the regulatory heat off DeFi platforms and stablecoin issuers that have been walking on eggshells in the States.

This optimism isn't just lifting AAVE – other DeFi tokens are catching the wave too. Curve Finance's CRV token jumped 8%, making it today's second-best performer. Meanwhile, Jupiter's JUP token on Solana climbed a respectable 5%. Not too shabby when everyone else is seeing red.

AAVE Flexes with Mind-Blowing $30B in Locked Value

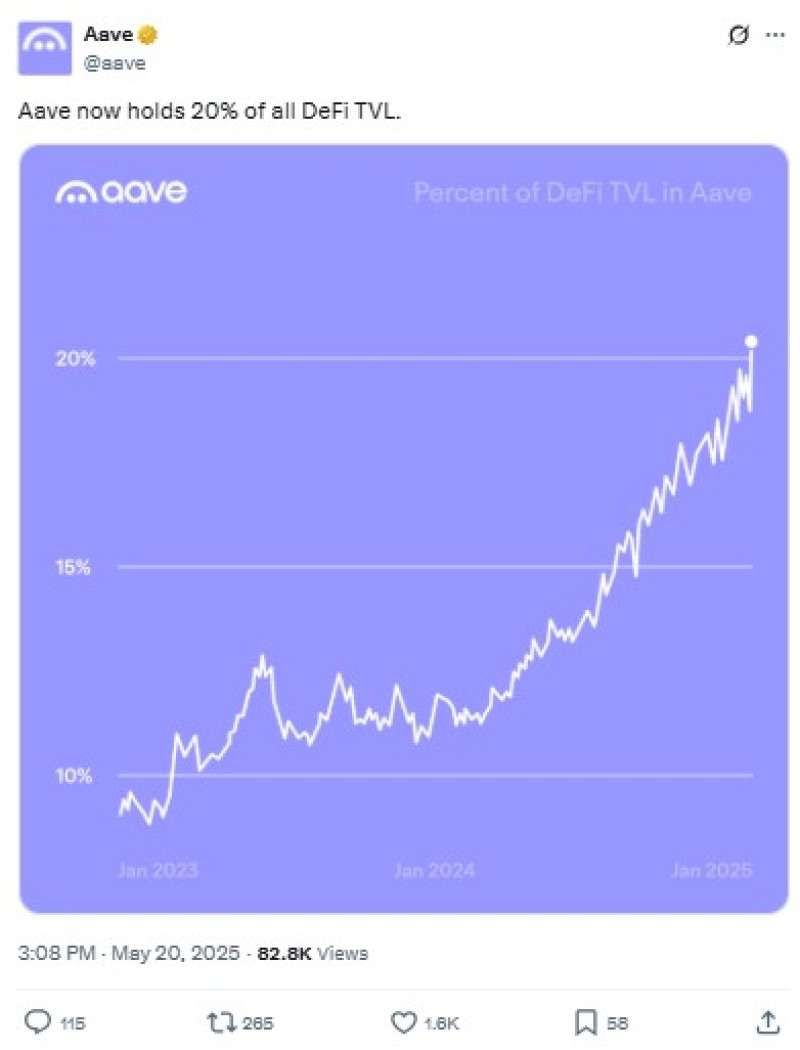

It's not just AAVE's price that's turning heads. The protocol itself is absolutely crushing it in terms of total value locked, recently smashing through previous records to hit an eye-popping $30 billion. That's not just impressive – it's downright dominant.

To put that in perspective, Aave now accounts for a staggering 20% of all value locked across the entire DeFi ecosystem. Even more mind-blowing? It exceeds all centralized finance platforms combined. We're talking about a single protocol that's become an absolute behemoth in the crypto lending space.

Is This the Altcoin Season We've Been Waiting For?

While Ethereum managed to eke out a modest 1% gain, major coins like XRP, BNB, DOGE, and ADA are all trending downward. Against this backdrop, AAVE's explosive performance has many analysts dusting off their crystal balls and declaring this could be the first tremor of an incoming altcoin earthquake.

The optimists are already throwing out predictions of $280-$300 in the near term, which doesn't seem far-fetched given today's momentum. After months of Bitcoin dominance and altcoin suffering, AAVE's breakout might just be the signal that smart money is rotating back into projects with strong fundamentals and real utility.

For a market that's been mostly sideways or down lately, this sudden jolt of life in the DeFi sector could be exactly the spark needed to ignite broader interest across the altcoin landscape. Whether this is a one-off surge or the beginning of something bigger remains to be seen, but AAVE holders are certainly enjoying the ride for now.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah