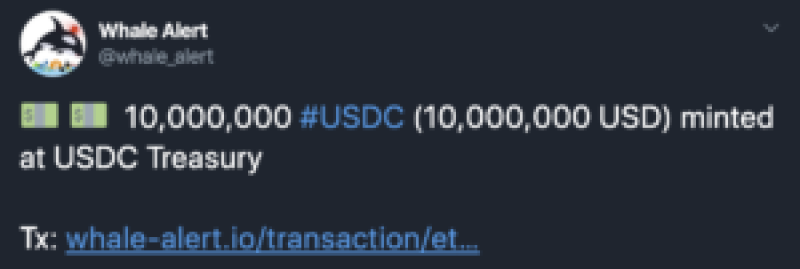

Circle, the company behind USDC stablecoin, reportedly printedanother 10M of coins. This happened amid the growing economic uncertainty caused by COVID-19. Earlier, the company’s CEO Jeremy Allaire claimedthat demand for stablecoins from business entities is on the rise. As the adoption of USDC grows, its circulating supply has also been growing, topping 50% MoM and $700Min absolute number.

Apparently, the crypto market’s participants have the same risk-off tendencies as their peers from the traditional markets. Businesses need liquidity to support operations. Hence, they sell volatile assets like altcoins into cash equivalents in the form of stablecoins.

As the global downturn continues, the demand for stablecoins is likely to grow. It is a lucrative market that has grown over $7Bin a cumulative market cap. Considering that the largest player in the space, Tether, has a history of issues with fractional reserveand regulators, we may see various players challenging Tether’s leading position. Among them are Circle (USDC), Binance (BUSD), and JUST (USDJ), recently announced by Poloniex.

Interestingly, Polinex was owned by Circle before it got bought by an Asian investment group including Justin Sun. While Circle lost a vehicle for growing USDC adoption, it has not lost its market. When the stake in Poloniex was sold, the exchange had to wind its operations down in the US, while Circle’s USDC is still availablefor American customers. Hence, there is likely to be market segmentation depending on jurisdictions and geographic locations.

Moreover, segmentation applies to how stablecoins work. On one hand, there are traditionally backed ones like USDT, USDC, TUSD, and alike. On the other hand, there are algorithmic stablecoins like Ampleforthand DAIthat may appeal to users concerned about decentralization and control.

To conclude, the race for becoming the go-to stablecoin only seems to begin with the unexpected invasion of COVID-19 in our daily lives. The more businesses will see the need for liquidity to pay the bills, the more stablecoins they will need to acquire. It’s a lucrative market, where players like USDC are likely to continue trying to capitalize on the emerging demand and printing more tokens.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi