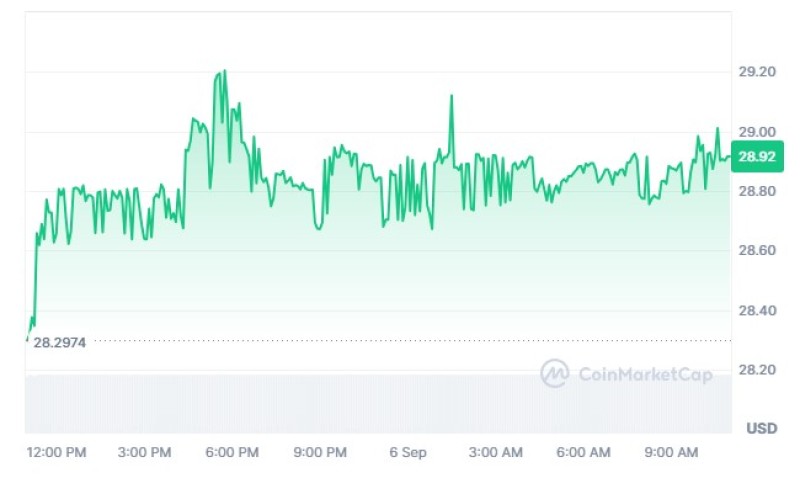

Silver (XAG/USD) remains in a tight range below $29 as traders await the release of US Nonfarm Payrolls (NFP) data, signaling potential future movements.

XAG/USD Struggles to Break Above $29 Resistance

Silver (XAG/USD) remained confined within a narrow trading range of around $28.80 during the Asian session on Friday, staying below its recent weekly high. Traders are exercising caution ahead of the much-anticipated US Nonfarm Payrolls (NFP) report, which could significantly impact market sentiment. With no fresh catalysts for directional movement, many are waiting to see how the employment data will shape future trends in the silver market.

Despite briefly touching the $29.00 mark, the inability of XAG/USD to maintain momentum above this level, combined with its failure to break the 100-period Simple Moving Average (SMA) on the 4-hour chart, is keeping traders cautious. Neutral oscillators on the daily chart further emphasize the need for a confirmed break above this resistance zone before taking a bullish stance.

Key Levels for XAG/USD in Focus

A sustained move above the $29.00 level could set the stage for XAG/USD to target the next resistance at $29.65, with the psychological $30.00 mark looming just above. Should the bullish momentum continue, silver may climb toward the August swing high of around $30.20, which could act as a fresh trigger for further gains. Beyond this level, XAG/USD might push towards $30.80 and eventually aim for the $31.00 psychological barrier.

On the downside, silver has established immediate support near the $28.50 region. A break below this level could accelerate selling pressure, pushing XAG/USD down towards the $28.00 mark. Further declines could see the commodity test the weekly low of $27.70. Any convincing breach of this threshold would likely lead to aggressive selling, driving XAG/USD towards intermediate support at $27.20 and potentially lower, to $27.00 and the next significant support at $26.60.

As traders await the NFP release, the silver market is at a crossroads. A stronger-than-expected jobs report could boost the US dollar, putting downward pressure on XAG/USD. Conversely, a weaker NFP print might spur a bullish breakout for silver as investors seek safe-haven assets amid economic uncertainty. Until then, XAG/USD will likely remain in consolidation mode as market participants position themselves for the next major move.

Conclusion

XAG/USD is currently in a consolidation phase, with critical resistance and support levels shaping its next move. The upcoming NFP report will likely act as a key catalyst for determining the near-term trajectory of silver prices. Traders should remain vigilant and be prepared for potential volatility following the employment data release.

Usman Salis

Usman Salis

Usman Salis

Usman Salis