Silver (XAG) got knocked down a peg on Tuesday, dropping over 1% to $34.37 per ounce after investors decided to cash in on the precious metal's wild ride to seven-month peaks. It's a classic case of what goes up fast often comes down just as quickly, especially when the dollar starts flexing its muscles again.

Silver (XAG) Goes from Hero to Zero in Just Two Days

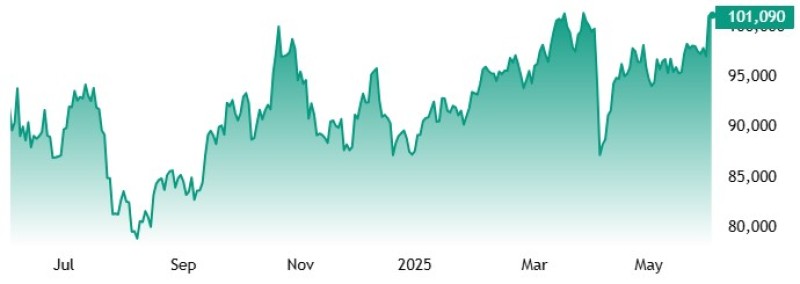

Talk about a rollercoaster ride. Just a day earlier, silver (XAG) was the star of the show, jumping a massive 5% and hitting its best levels in seven months. But Tuesday? Complete turnaround. The white metal couldn't hold onto those gains as reality set in and traders started taking their winnings off the table.

It's pretty typical behavior, really. When you see such explosive moves like silver (XAG) had on Monday, there's always going to be some folks ready to lock in profits the next day. And when the dollar started looking stronger again, it made silver more expensive for buyers using other currencies – not exactly a recipe for keeping the rally going.

The Dollar's Comeback Story Hits Silver (XAG) Hard

Here's the thing that really hurt silver (XAG) – the US dollar decided to make a comeback right when everyone was getting excited about the precious metal. The greenback picked up steam ahead of some key jobs data coming out later this week, and that's bad news for silver since a stronger dollar makes it pricier for folks buying with other currencies.

Everyone's got their eyes glued to these upcoming labor numbers because they could give us a clue about what the Fed's planning to do with interest rates. You know how it goes – if the data looks strong, it might push the Fed toward keeping rates higher, which would be another boost for the dollar.

It's always been this way with silver (XAG) and the dollar – when one goes up, the other usually heads down. So if this dollar bounce keeps going, silver might have a tough time getting back to those highs we saw earlier this week. Traders are basically trying to figure out if this is just a quick dollar rally or if we're looking at something more long-term.

Trade Drama and Gloomy Forecasts Keep Silver (XAG) Investors on Edge

But wait, there's more weighing on silver (XAG) right now. The whole trade situation between the US and China has got people nervous, and that's never good for market confidence. Word is that Trump might be getting on the phone with China's Xi Jinping this week, and after all those tariff accusations flying around, investors are playing it safe.

Nobody wants to be caught holding the bag if trade tensions suddenly explode again. And it's not just the US-China thing – the OECD just came out and slashed their global growth forecasts, which is basically their way of saying "yeah, things aren't looking so hot for the world economy."

When you combine all this uncertainty – trade wars potentially heating up, slower global growth on the horizon, and the dollar getting stronger – it's no wonder people are taking some chips off the table with silver (XAG). The metal's always been seen as a safe haven, but if industrial demand starts dropping because of slower growth, that could offset some of those safe-haven benefits.

Right now, silver (XAG) traders are basically juggling a bunch of different balls – trying to figure out if the economic slowdown fears are real, whether trade tensions will escalate, and if the dollar's strength is here to stay. It's a tricky environment, and Tuesday's pullback shows just how quickly sentiment can shift in these markets.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah