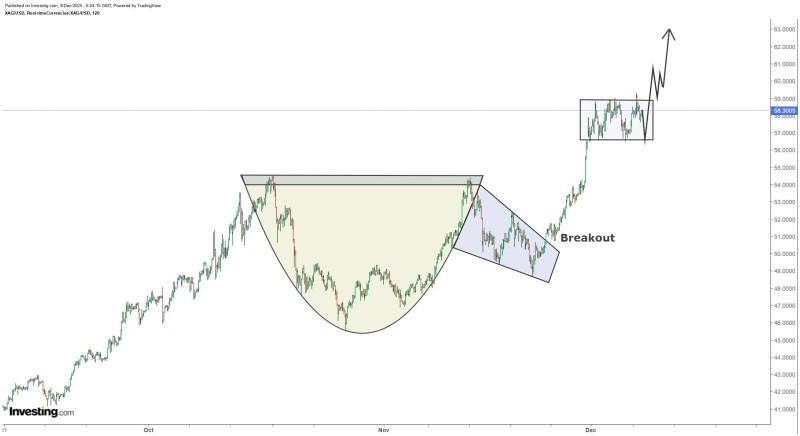

⬤ Silver has extended its rally after forming a textbook Cup and Handle pattern on the chart. The structure is playing out as expected, with XAG/USD gaining momentum following the handle's completion. Price is now stabilizing around $58.30, where a brief consolidation zone has developed, while the broader technical picture points to further upside potential toward the stated target.

⬤ The chart reveals how silver first carved out the rounded cup throughout October and November before forming a tighter handle and breaking higher. This surge pushed XAG well past $56 and into a narrow range just under $59. The immediate objective near $63 matches the measured move typically associated with this setup. The projected path shows expectations for continued strength once the current consolidation gives way to fresh upward momentum.

⬤ Market structure looks solid, with silver holding higher lows and staying above important support zones. The chart shows repeated strength within the consolidation box, signaling that buyers remain engaged even after the powerful climb from the mid-$40s. With the Cup and Handle pattern now confirmed, the outlined trajectory reflects current market sentiment and suggests XAG may test higher resistance levels if momentum persists.

⬤ This matters because silver's technical setup has turned decidedly bullish, positioning XAG to approach its next major price zone. A push toward $63 would represent a meaningful extension of the current trend and shape expectations across the precious metals market. The pattern's strength highlights improving sentiment and shows traders are watching closely for the next phase of this move.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov