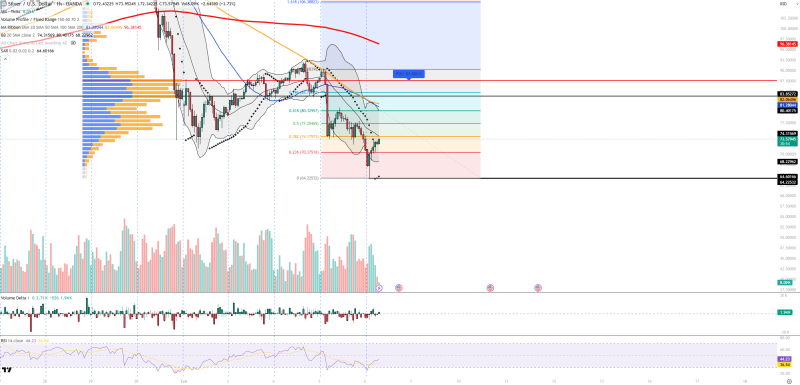

⬤ Silver on the hourly XAG/USD chart tried pushing higher after getting hammered lower, but don't be fooled—the overall picture still looks bearish. That recent uptick? More like a dead cat bounce than anything real. Price is still stuck below the descending trendline, the 20 and 50 period moving averages, and the Bollinger middle band—all acting like brick walls right now.

⬤ The indicators aren't showing much buying conviction either. RSI sitting around 44 means momentum is pretty weak even after bouncing from oversold territory. Volume during the bounce stayed thin, which tells you buyers aren't exactly rushing in. Looks more like shorts taking profits than fresh money entering. The Parabolic SAR is still sitting above price, confirming this downtrend hasn't broken yet.

⬤ Deeper technicals back up the bearish case. The volume profile point of control near 87.56 is way above current levels—that's a massive supply zone overhead. The bounce came right off the lower Bollinger band, textbook technical reaction stuff. Key support levels to watch are at 73.57, 70.37, 68.22, and 64.60. Resistance is stacking up at 74.31, 77.25, 80.40, and 83.85. Volume delta is barely positive, suggesting limited short covering rather than real accumulation.

⬤ The bigger macro picture keeps weighing on silver too. Strong dollar and rate expectations are crushing XAG/USD, and there's no bullish catalyst coming from industrial demand right now. This recent movement is just technical noise. The bearish structure stays in play unless silver can actually break and hold above those resistance levels.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi