Silver (XAG) futures have reached a critical juncture as they trade within an increasingly tight wedge formation. After a strong rally earlier this week, the precious metal is now consolidating near key technical levels, with traders positioning for what could be a significant directional move. The current price action suggests that a breakout is imminent, potentially setting the stage for substantial volatility in either direction.

Silver's Short-Term Setup

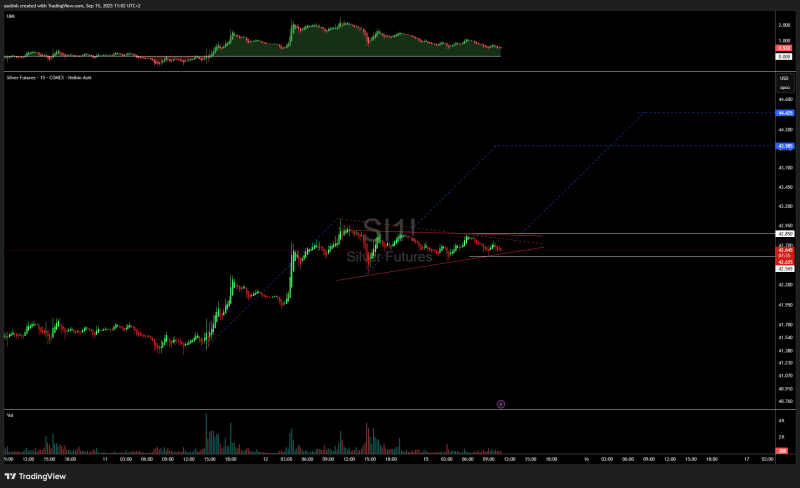

Silver futures are at a make-or-break point, trading just below resistance at $42.85 while compressing into a wedge formation. With volatility building, traders expect a decisive move today that could send silver either surging above $44 or slipping back toward $42.00.

Analyst UseliNk highlighted these levels, noting that the short-term setup has narrowed to a critical range marked by the white lines on the chart.

This technical compression often precedes explosive price movements as market participants await clarity on direction.

Chart Analysis: Silver Futures in Tight Consolidation

The 15-minute chart shows silver locked inside a wedge after its strong upward move earlier this week. The immediate support sits at the lower white line around $42.56, which represents key short-term support. A breakdown here could invite sellers and accelerate losses toward the $41.90–$42.00 zone. Meanwhile, immediate resistance at the upper white line near $42.85 continues blocking upside momentum, but a clean breakout above could unlock a new rally phase.

Upside targets based on projected dotted blue paths point to potential moves toward $43.98 and $44.42 if bulls successfully take control. Volume signals during the wedge formation show declining activity, indicating market indecision. However, a spike in trading volume will likely confirm whichever direction the eventual breakout takes. This compression reflects an ongoing tug-of-war between bulls and bears, though the current equilibrium is unlikely to persist much longer.

Why Silver Is Pausing Now

Several macro drivers explain why silver has stalled after its recent rally. U.S. dollar strength has limited gains across precious metals, creating headwinds for silver's advance. Markets are also awaiting fresh Federal Reserve policy guidance that could shift expectations regarding interest rates and real yields, both of which significantly impact precious metals pricing. Despite these short-term uncertainties, ongoing inflation concerns and geopolitical risks continue to underpin silver's long-term appeal, even as traders wait for clearer directional signals.

Trading Scenarios

The wedge formation provides a clear technical roadmap for potential outcomes. In the bullish scenario, a clean breakout above $42.85 could trigger renewed buying pressure, potentially targeting the $44.00–$44.40 range in the near term as momentum traders pile in. Conversely, in the bearish scenario, a break below $42.56 would expose silver to further declines toward the $41.90–$42.00 support zone, where longer-term buyers might emerge.

Usman Salis

Usman Salis

Usman Salis

Usman Salis