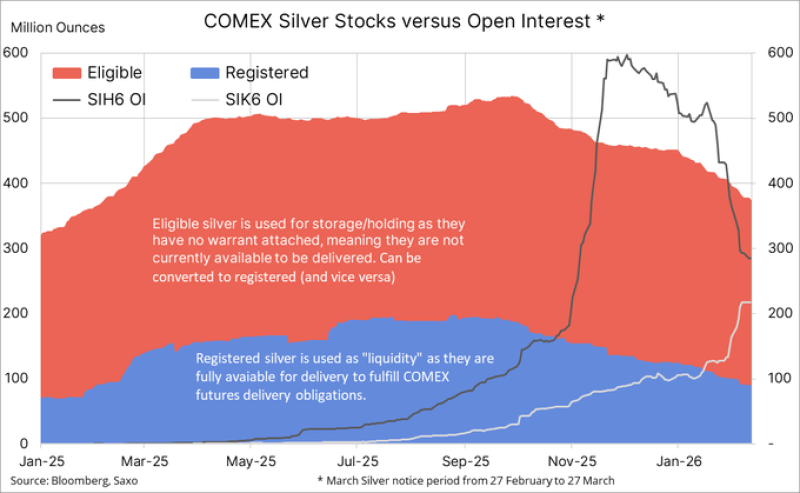

⬤ The silver futures market is catching eyes as front month contracts stack up beyond what's actually available for delivery. The March contract (SIH6) is sitting well above registered COMEX silver stocks with just nine days left before the 30-day delivery window kicks in. The gap between paper contracts and physical metal is creating an interesting setup.

⬤ Here's the thing - registered silver is what can actually be delivered against contracts, while eligible silver is just sitting in storage without delivery warrants attached. The spread between March (SIH6) and May (SIK6) contracts is holding around 56 cents in contango, which tells us neither long nor short traders are rushing to roll their positions yet. But that's about to change. Open interest should drop hard in the coming days as traders either roll forward or close out entirely. We saw something similar play out recently when contracts moved from March to May.

⬤ Last week alone, March open interest fell by 10,900 contracts while May climbed by 7,800. Total open interest across all silver futures now sits near 132,000 - the lowest we've seen since September 2024. That's not expansion, that's contraction. Hansen notes that this positioning dynamic echoes themes from earlier episodes where paper claims far exceeded registered inventory, and premium patterns between Shanghai spot and COMEX deliverables.

⬤ As the delivery period gets closer, traders typically adjust their books - either rolling exposure forward or closing out positions completely. The relationship between open interest and registered supply shows how futures positioning shifts when settlement deadlines approach in the COMEX silver structure.

Peter Smith

Peter Smith

Peter Smith

Peter Smith