⬤ Silver futures activity is picking up as traders shift their positions into later contracts. Investors are actively rolling March 2026 COMEX silver futures into May ahead of February's settlement deadline.

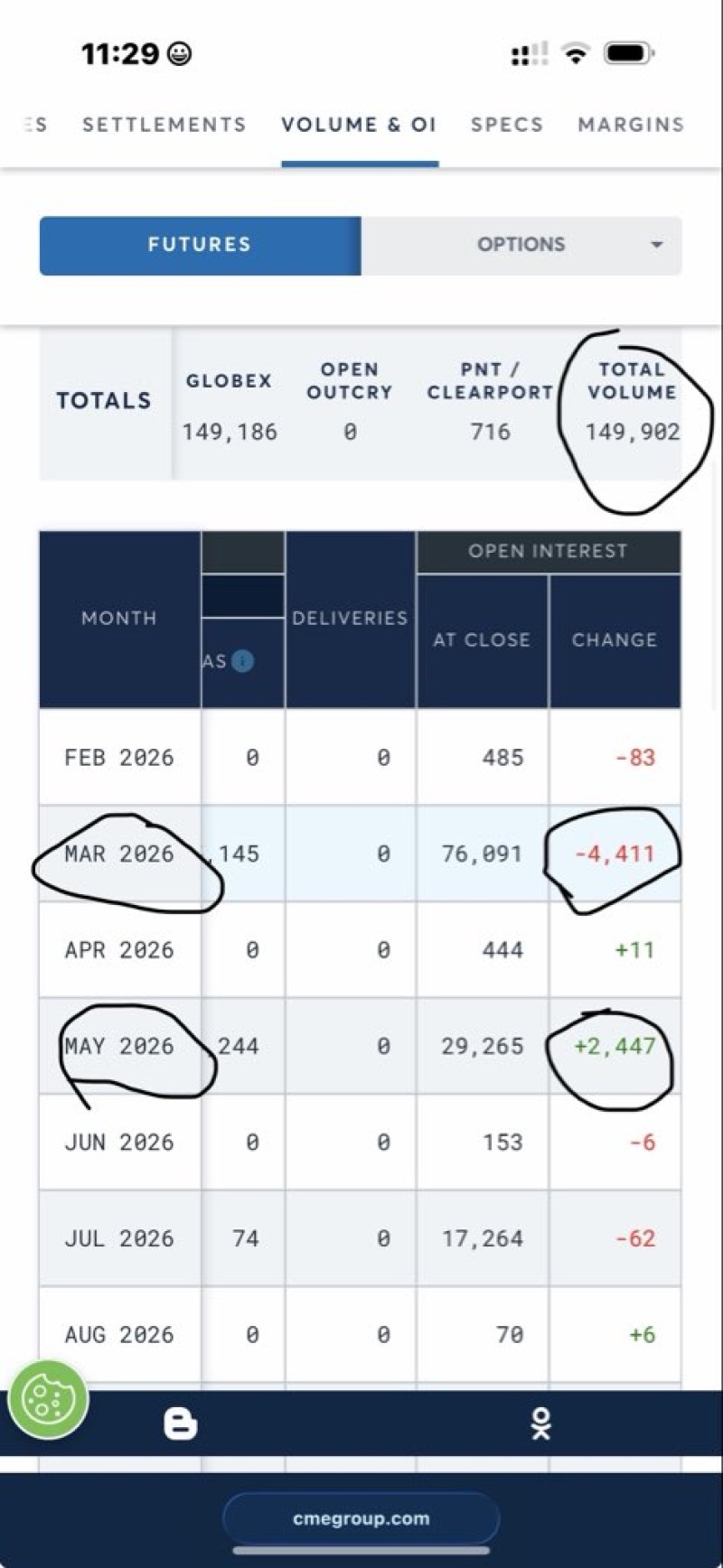

⬤ CME data reveals total open interest sitting near 149.9K contracts, with roughly 76K March contracts still waiting to be cleared before month-end. Meanwhile, positions are flowing into May—open interest there jumped by about 2,447 contracts while March dropped by around 4,411 contracts.

⬤ This movement shows repositioning rather than an exit from silver markets. Instead of closing out, participants are rolling forward earlier than normal, keeping their exposure to silver price action beyond the delivery window.

⬤ The faster these 76K March contracts clear or roll into May, the sooner the next silver rally might kick off. As positioning moves away from settlement pressure and into the next active trading month, silver could gain momentum earlier than usual.

Peter Smith

Peter Smith

Peter Smith

Peter Smith