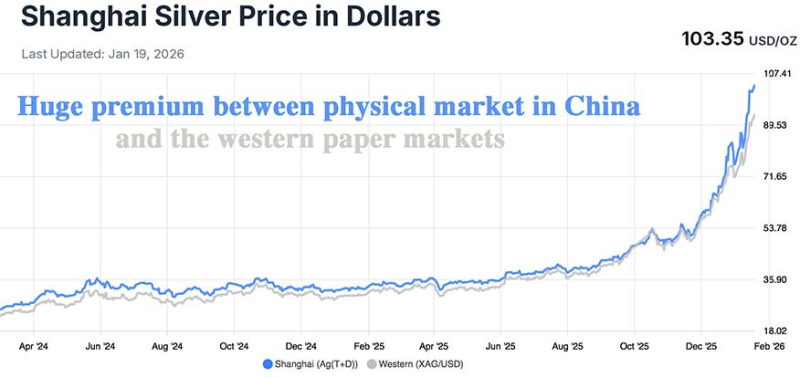

⬤ Silver market pricing has drawn renewed attention as Shanghai prices move sharply above Western benchmarks. Questions are increasingly being raised about whether silver prices should still be assessed primarily through London or New York markets, as current dynamics suggest Shanghai is becoming a key reference point. The attached chart illustrates a clear and sustained gap between Shanghai silver prices in US dollars and Western XAG pricing.

⬤ According to the data, Shanghai silver prices have climbed above $100 per ounce by early 2026, while Western silver prices remain significantly lower over the same period. This has resulted in a pronounced premium in the Chinese market. The divergence became especially visible toward the end of 2025, indicating that pricing behavior in Shanghai has decoupled from traditional Western benchmarks tracked through futures and paper markets.

⬤ The chart reinforces the idea that while Western markets continue to reflect paper-based trading structures, Shanghai pricing appears more closely aligned with physical market conditions. This has sparked growing discussion around whether global silver price discovery is becoming more geographically fragmented, with Asia increasingly driving the conversation.

⬤ This shift matters for anyone involved in precious metals. A persistent premium in Shanghai suggests that regional market signals may increasingly diverge from established global benchmarks, making it crucial to monitor where silver prices are actually being formed and which markets carry the most weight.

Peter Smith

Peter Smith

Peter Smith

Peter Smith