⬤ The Platinum/Gold ratio is holding strong within its uptrend, showing platinum's continued outperformance against gold. After a solid rally, the ratio has shifted into consolidation mode, but the technical picture remains healthy. Price action is staying above a rising support line, which means the overall uptrend structure is still in place despite the recent pause.

⬤ Lately, the ratio has been trading sideways near the top of its recent range. This looks more like a high-base consolidation—basically the market taking a breather after earlier gains—rather than anything bearish. The ratio keeps making higher lows, and price is still respecting that ascending trendline you can see on the chart. Bottom line: platinum's relative strength versus gold hasn't really weakened.

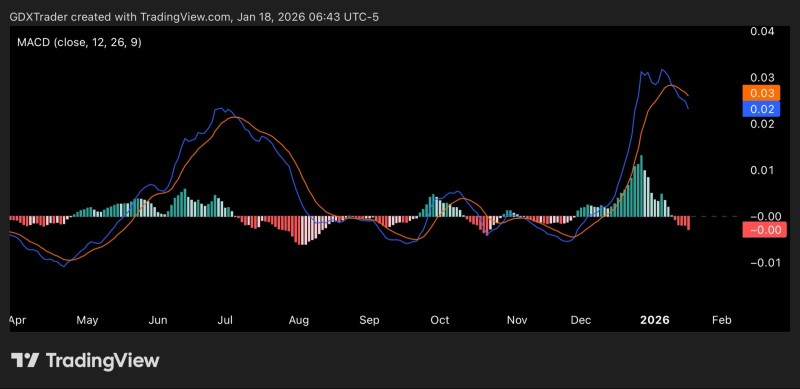

⬤ Momentum indicators have cooled off during this consolidation, which matches what the technicals are showing. The MACD has crossed below its signal line, and the RSI has pulled back from elevated levels toward the middle range. But here's the key: even with these softer momentum readings, the ratio itself hasn't made any serious move lower. The price is consolidating sideways, not breaking down.

⬤ This setup matters for anyone watching the precious metals space, since the Platinum/Gold ratio is a go-to gauge for relative strength between these two metals. As long as the ratio keeps printing higher lows and holding that upward slope, the technical bias favors platinum over gold. Short-term choppiness during consolidation is normal, but the core trend structure shown on the chart is still intact.

Usman Salis

Usman Salis

Usman Salis

Usman Salis