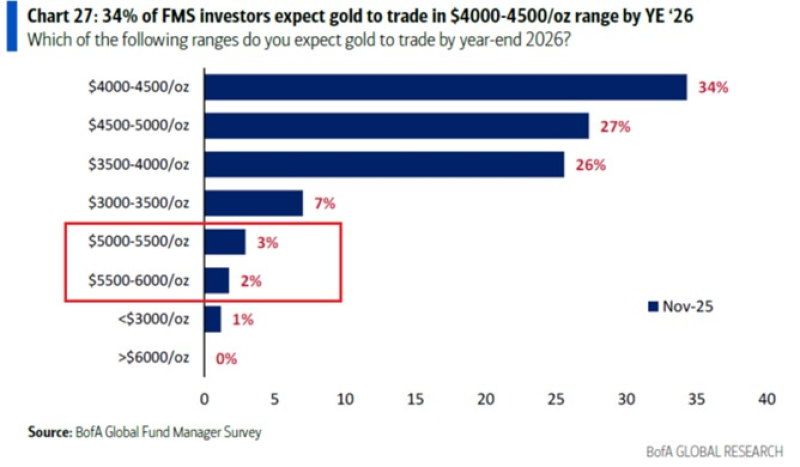

⬤ New survey data is shedding light on where institutional investors think gold prices are headed through 2026. Most professional money managers are playing it safe with their forecasts, keeping expectations in a moderate range. Only 5 percent see gold breaking above $5,000 per ounce in the next two years.

⬤ The most popular forecast? A landing zone between $4,000 and $4,500 per ounce, backed by 34 percent of survey respondents. Another 27 percent think we'll see prices climb higher into the $4,500 to $5,000 bracket, while 26 percent expect something more conservative between $3,500 and $4,000. On the lower end, 7 percent anticipate a dip into the $3,000 to $3,500 range. Very few are betting on extremes—just 3 percent see $5,000 to $5,500, and 2 percent forecast $5,500 to $6,000.

Gold is no longer classified as the 'most crowded' trade after topping that list in October.

⬤ What's equally interesting is who's not buying in. The survey found that 39 percent of professional investors currently hold zero gold exposure, despite its long-standing reputation as a hedge against uncertainty. Gold has also dropped off the radar as the "most crowded" trade after leading that category just months ago in October. The bulk of forecasts cluster around mid-tier price levels, signaling caution about any dramatic rally.

⬤ Gold price trends typically ripple through portfolio strategies, influencing how investors hedge risk and allocate capital across asset classes. With most forecasts landing between $3,500 and $5,000, it looks like the institutional crowd is bracing for stability rather than fireworks. That outlook could shape how money flows through commodity markets as we move closer to 2026.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova