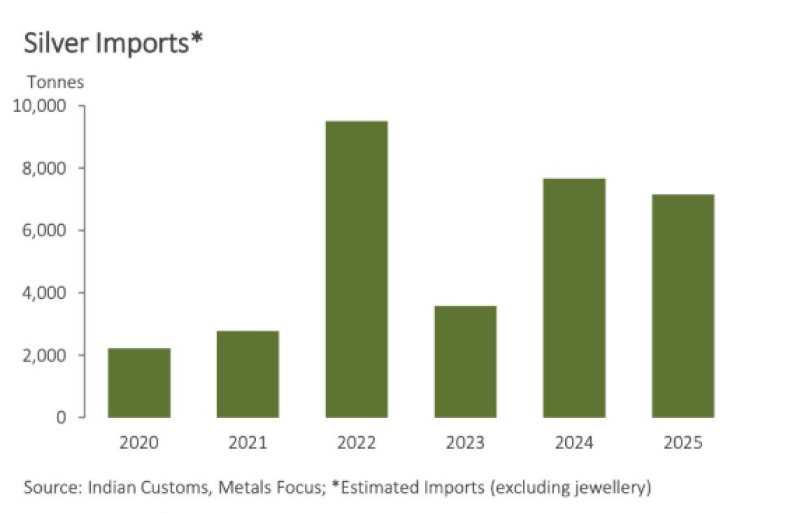

⬤ India is emerging as the dominant force behind global silver physical demand, with imports staying sky-high across recent years. The country pulled in roughly 230 million ounces of silver in 2024 and about 220 million ounces in 2025, proving buyers keep coming even when prices climb.

⬤ The chart tracks import volumes in tonnes, including a sharp spike in 2022 followed by consistently elevated levels through 2024 and 2025—no collapse in sight. Converted to ounces, those inflows represent roughly one quarter of annual global mine supply absorbed by a single country. That kind of accumulation marks India as a structural buyer in the physical silver market, not a short-term speculator. Similar structural shifts appeared in Silver price breakout signals rally, where technical momentum aligned with underlying demand.

⬤ Despite elevated prices, purchasing activity stays resilient, showing demand isn't highly price sensitive. Broader precious metals behavior also highlighted silver's strength relative to gold in Silver outperforms gold as ratio breaks support.

⬤ Concentrated buying at this scale shifts global market balance because physical flows determine available supply across trading hubs. Continued accumulation by a major importer reinforces how real-world consumption shapes price direction and shows regional demand patterns can drive the broader silver market cycle.

Peter Smith

Peter Smith

Peter Smith

Peter Smith