Returns will rise, and the Government will have no alternative but to lend at increasingly lower interest rates. Warehouses may provide a kind of refuge for the repression, but gold may become the most apparent protection – the highest in nearly a decade.

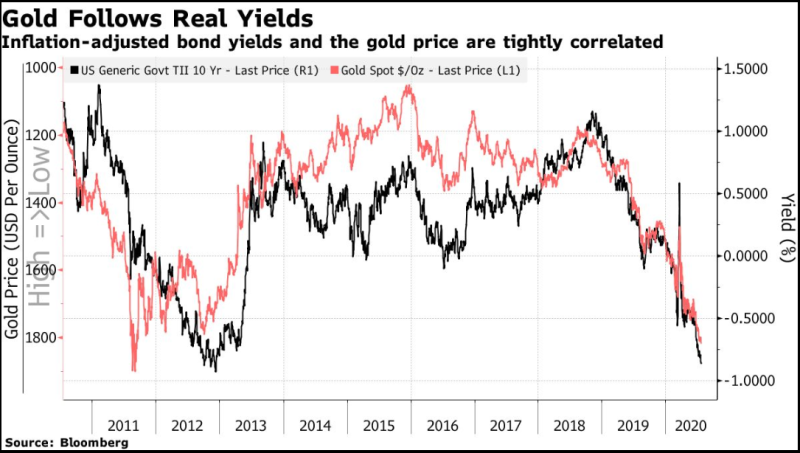

John Authors, an editor-in-chief of Bloomberg magazine, cites historical data that shows that gold increases in price when yields fall too low.

The main feature of gold as an asset is that it pays no return. Thus, as the actual return on alternative investment is negative, the graph with inverted gold price shows that low real returns ultimately leads to higher prices of gold: It is even more attractive.

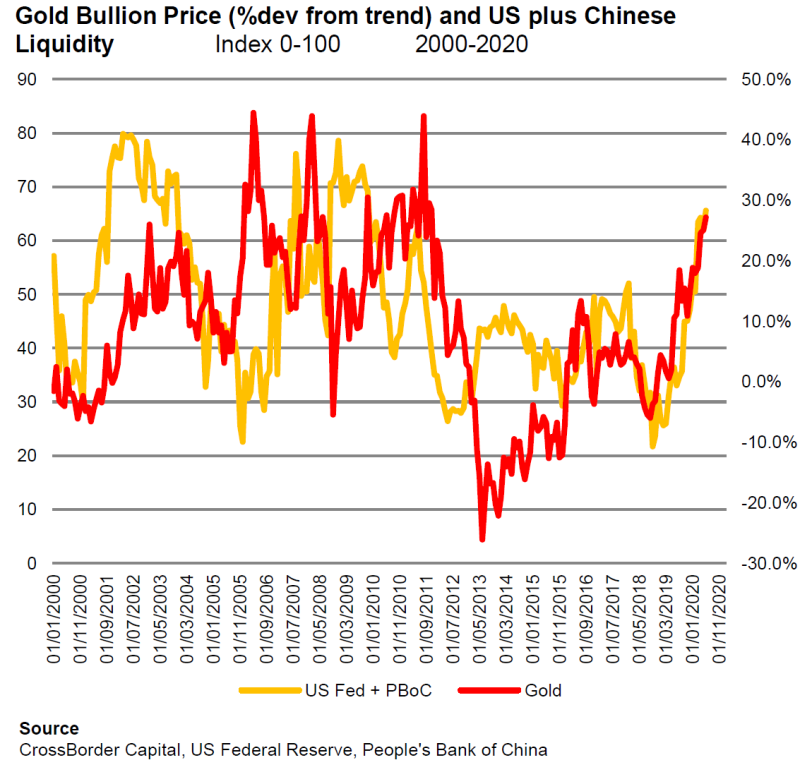

There are other ways to prove that the present excellent monetary circumstances will support gold. The discrepancy in the price of gold from its average is demonstrated in this chart toward the mix of the US and China liquidity. There has been a clear correlation over the last 20 years.

To get back to where we are now, a rise of about 40% in the price of gold will be necessary. More debt means higher price of gold.

The stock rally currently still shows little confidence in an economic recovery, but for a long time, the bond market is revealing great confidence in financial repression. It could be worth taking some gold to profit from this persecution.

The positive around gold is growing every day. Many investors consider it the main anti-crisis and safe asset. So, according to some forecasts, the price of gold may reach $2,000 by September of 2020.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah