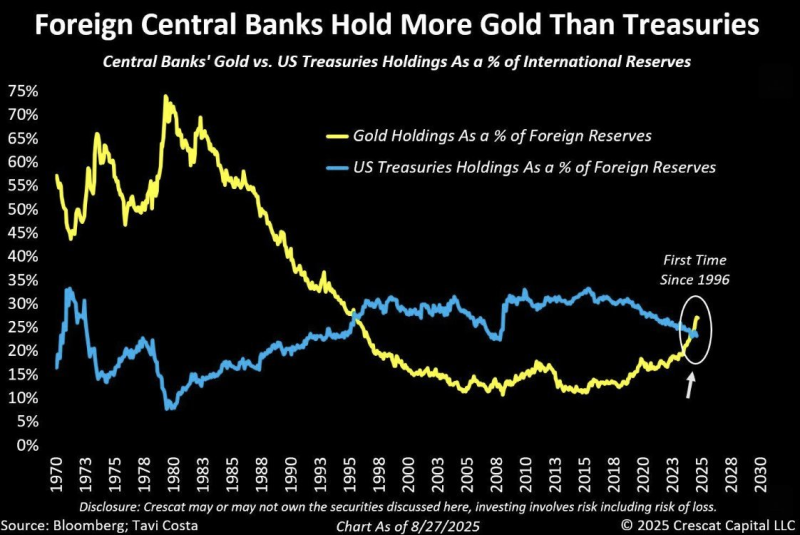

● For the first time since 1996, foreign central banks are holding more gold than U.S. Treasuries—a historic turning point in how countries manage their reserve assets.

● In a recent post, Barchart pointed out something remarkable: foreign central banks now own more gold than U.S. Treasuries as a percentage of their total international reserves. This hasn't happened since 1996, based on data gathered by Bloomberg and Tavi Costa from Crescat Capital.

● Looking at the chart, you can see how gold (the yellow line) and U.S. Treasuries (the blue line) have essentially swapped positions since the 1970s. Gold was king during the oil crises and inflation chaos of that decade, while Treasuries took over from the late '80s onward as the dollar became everyone's go-to safe haven. But the latest numbers—updated through August 27, 2025—show a clear crossover: gold holdings have officially overtaken Treasuries as a share of foreign reserves for the first time in almost three decades.

● So what's driving this shift? It comes down to central banks—particularly in Asia and the developing world—rethinking their reliance on U.S. fiscal policy and the dollar's role in global trade. They're diversifying away from American debt, looking for more monetary independence. But this isn't without consequences. If fewer countries are buying Treasuries, U.S. borrowing costs could climb, bond markets could get shaky, and we might see more financial volatility worldwide.

● The financial implications are serious. With foreign institutions pulling back on Treasury purchases, the U.S. could find it harder to fund its massive deficits—now running over $2 trillion a year. Gold doesn't pay interest, sure, but it also doesn't carry counterparty risk, which is becoming increasingly appealing in a world full of geopolitical tensions and sanctions. Some experts are suggesting a more balanced approach: mixing in commodities, regional currencies, and sovereign wealth assets rather than leaning so heavily on U.S. debt.

Usman Salis

Usman Salis

Usman Salis

Usman Salis