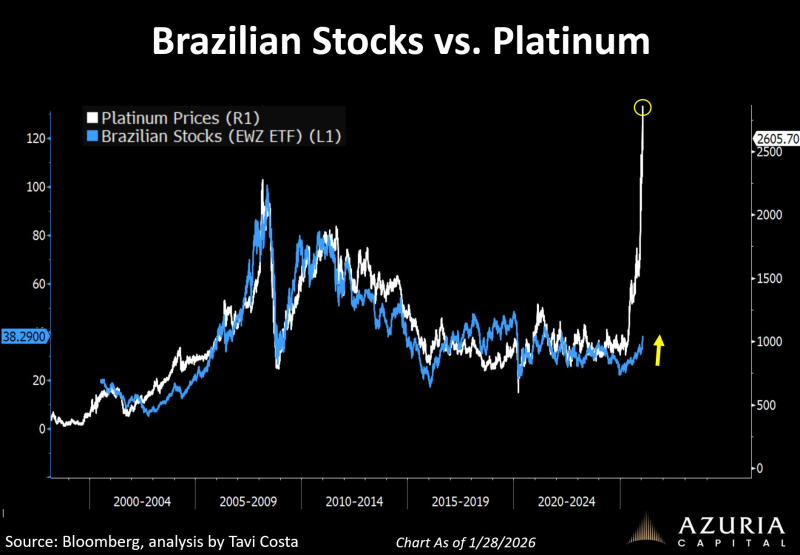

⬤ Brazilian stocks and platinum prices don't seem connected at first, but looking at 20+ years of data tells a different story. Both markets move through the same long-term cycle driven by gold and commodities. The chart comparing platinum with Brazilian equities through the iShares MSCI Brazil ETF (EWZ) shows how these two assets have gone through similar phases since the early 2000s.

⬤ When precious metals rally, Brazilian stocks typically follow. The pattern's been consistent across multiple commodity cycles. Platinum saw major price surges during past upcycles, with Brazilian equities advancing alongside—though the timing and strength varied based on what was happening in the broader economy. Recently, platinum jumped sharply while Brazilian stocks stayed relatively quiet, showing it's more about different timing than the relationship falling apart.

Over a five- to ten-year horizon, these second- and third-order dynamics help explain why assets like platinum and Brazilian stocks may attract renewed attention well after initial moves in gold have already occurred.

⬤ Here's how the cycle typically plays out: gold leads, then silver and copper follow, then mining stocks and emerging markets join in. Platinum and palladium show up as second and third waves of the same trend, right alongside commodity-heavy economies like Brazil. The data shows these later moves unfold over years, not weeks or months.

⬤ Why does this matter? It means Brazilian equities aren't just a regional play—they're part of a multi-year commodity supercycle. When capital starts flowing into precious metals and commodities, it eventually spreads to emerging markets. This 5-10 year pattern explains why platinum and Brazilian stocks often get attention long after gold's already made its initial move.

Peter Smith

Peter Smith

Peter Smith

Peter Smith