Reduction Of Dollar Positions

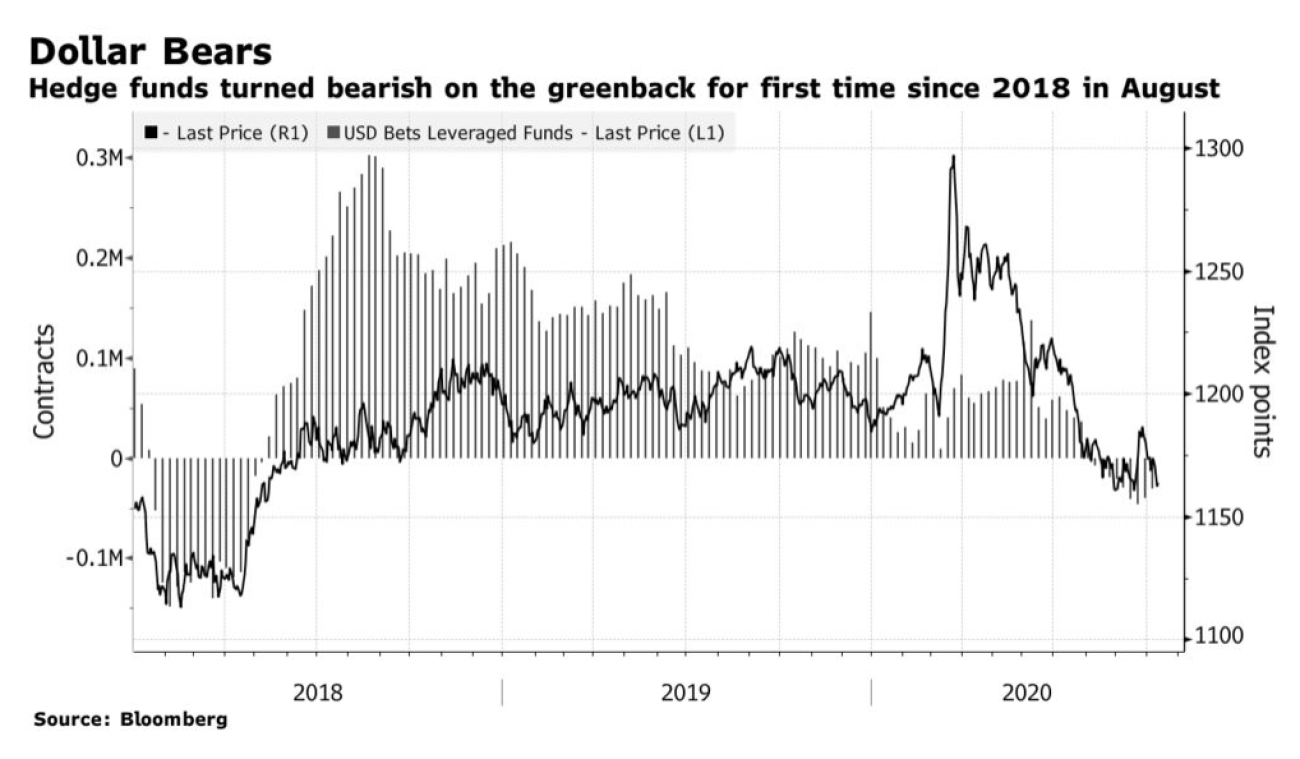

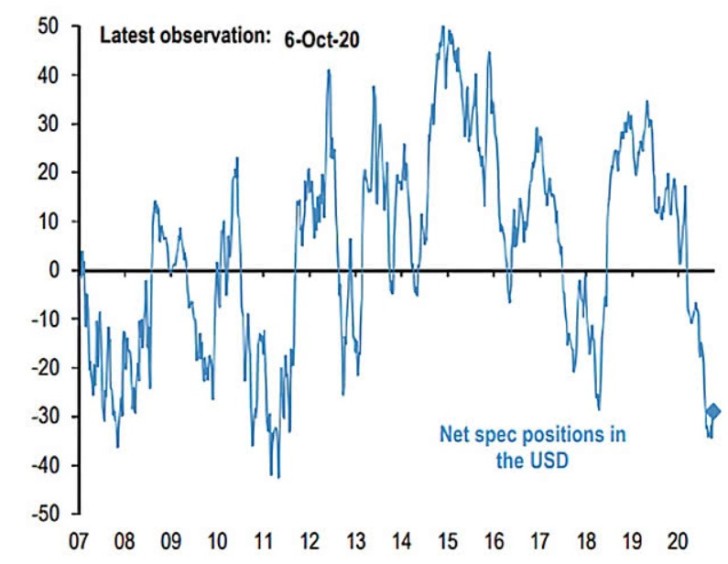

Hedge funds that have racked the highest bets against the dollar in nearly 3 years are expected to be squeezed headlong. Certain hedge fund managers are betting on the stocks with the expectation that the profits of the firm will fade sooner than anticipated by many investors.

The estimates of the currency's downturn as a global leading haven look premature in markets on the verge of resurgent coronavirus cases and a contested US presidential election.

Multi-year tops of dollar shorts, all cut last week. In light of the many risks that are caused by the global pandemic, it highlights the risk of betting on the currency.

Dollar As a Safe Haven

Thus, the V-shaped recovery and the trillions of dollars in bonuses have intensified the reflation trade over protective assets such as the dollar throughout the summer. Yet even though pandemic controls threaten to smother economic green shootings, the recent political meeting of the Federal Reserve stopped short of any meaningful moves for further stimulus.

Investors supported the winners of an economical battle against the Covid and made positive wages on stocks, especially in view of the strong turnaround on the market in 2020. But now, the IT market, led by new short positions, has become one of the main risk-taking by hedge funds in these last weeks.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi