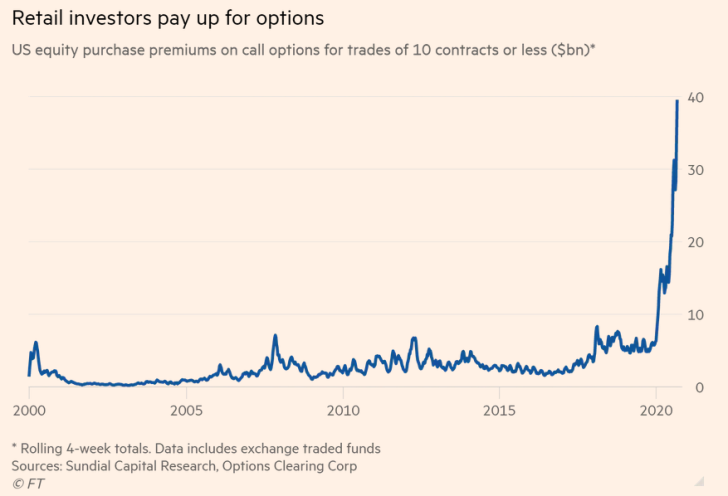

The number of retail investors interested in buying options has grown tremendously in 2020, according to Michael A. Gayed. To a certain extent, this is due to the actions of electronic brokers, such as Robinhood, who allowed their clients to trade options and then canceled or reduced commissions for these operations.

Such interest in options trading on the part of retail investors is a negative sign for the market. As a rule, such growth precedes the onset of correction, and these investors themselves, by their actions, increase volatility on the market, starting to trade with leverages having high hopes of quickly getting the jackpot.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov