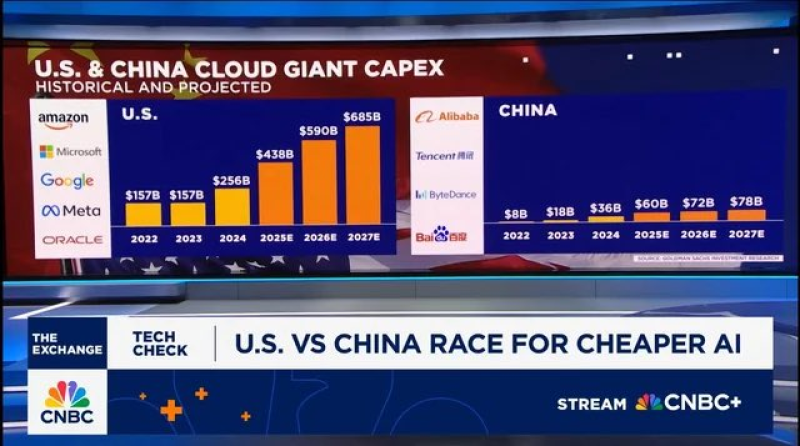

⬤ American tech giants are ramping up their AI investments at an unprecedented pace. Recent projections show Amazon, Microsoft, Google, Meta, and Oracle planning to pour $256 billion into AI infrastructure in 2024, jumping to $438 billion in 2025, then $590 billion in 2026, and hitting $685 billion by 2027. This massive spending spree is all about building out data centers packed with Nvidia chips to handle everything from AI training to real-time inference.

⬤ Chinese cloud companies aren't even playing in the same league. Alibaba, Tencent, ByteDance, and Baidu are projected to invest just $36 billion in 2024, climbing to $60 billion in 2026 and $78 billion by 2027. Part of this gap comes down to market reach - U.S. companies serve customers worldwide while Chinese platforms mostly stick to their home turf. But there's another factor: if China had access to Nvidia's latest GPUs, spending could jump by roughly $50 billion annually. Export restrictions are creating a real dividing line.

⬤ What's interesting is that this isn't just about chatbots and language models. A big chunk of the money is going toward accelerated computing for things like recommendation engines and ranking systems that power social media feeds and online shopping. China's spending is growing steadily, but even looking years ahead, it stays dramatically smaller than what American companies are planning.

⬤ This spending gap matters because it directly shapes who leads in AI technology and economic growth. Higher U.S. investment could speed up innovation and cement dominance in cloud services. Meanwhile, China's restricted access to advanced chips is clearly limiting how fast it can build out its AI infrastructure, which could impact its contribution to global GDP as AI becomes more central to the economy.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova