● Nvidia CEO Jensen Huang isn't buying the bubble talk. In an update shared by Unusual_whales, Huang pushed back against claims that AI is overhyped, saying he doesn't believe we're in a bubble — right before Nvidia's stock crossed $200 for the first time ever.

● The rally reflects Nvidia's central role in powering AI infrastructure worldwide, from data centers to self-driving cars and generative AI tools. Critics argue valuations are getting ahead of earnings, but Huang insists the growth is driven by real adoption, not hype.

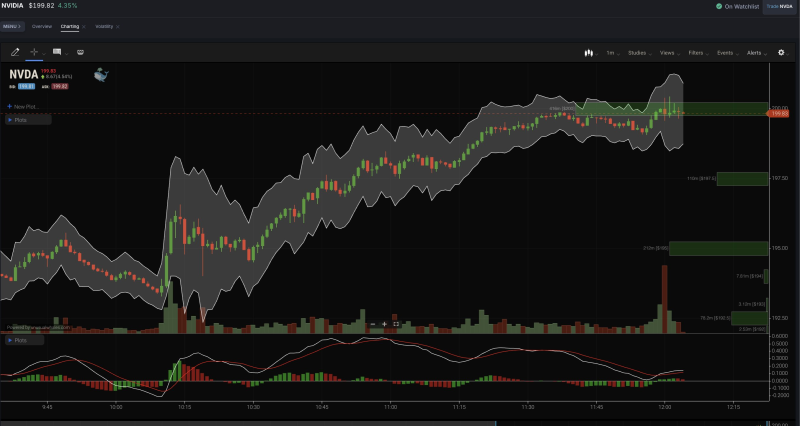

● The stock jumped 4.35% to around $199.82, lifting the entire semiconductor sector with it. Companies like AMD, TSMC, and Broadcom gained ground as investor confidence in AI chips strengthened. Analysts see the $200 breakout as a sign of institutional backing, though some caution that profit-taking could bring short-term volatility.

● Nvidia's weight in the S&P 500 and Nasdaq-100 means its performance directly impacts broader market gains. Sustained momentum could fuel more corporate spending on AI infrastructure and support wider economic growth.

● Huang's comments double as both reassurance and strategy — positioning Nvidia's AI expansion as a long-term shift, not a fleeting trend. The company continues securing partnerships and scaling production to stay at the center of the AI revolution.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova