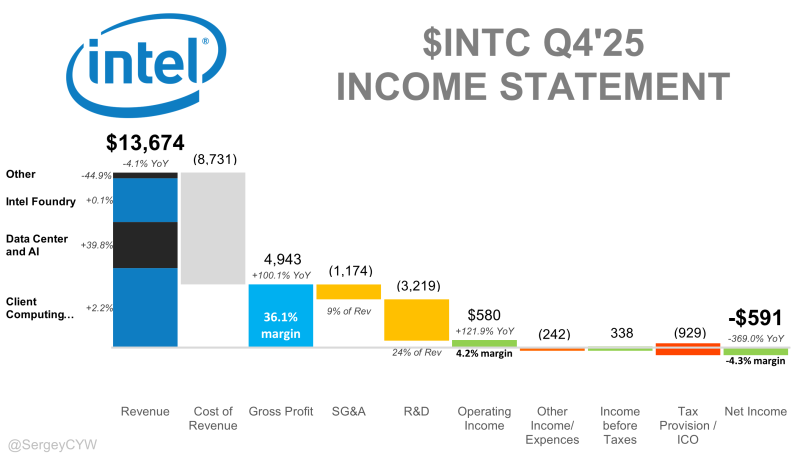

⬤Intel's Q4 2025 numbers tell a story of recovery beneath the surface. Revenue came in at $13.7 billion—down about 4% from last year—but here's the thing: profitability is coming back fast. Gross margin hit roughly 36%, up nearly 19 percentage points year over year, while operating income reached around $580 million. That's an operating margin of about 4.2%, a massive swing from the losses Intel was posting a year ago. Cost cuts and product mix improvements are clearly starting to work.

⬤The real action this quarter was in Data Center and AI, where revenue jumped close to 40% year over year. Demand for server and AI workloads is strong, and segment profitability improved meaningfully with EBIT margin expanding nearly 10 percentage points. Client Computing is stabilizing after a rough stretch, and custom silicon revenue crossed the $1 billion annualized mark in Q4. Intel also started shipping its 18A process and began generating revenue from advanced packaging deals, showing management's push into higher-margin products is gaining traction.

Supply, not demand, is now the primary bottleneck.

⬤But the near-term picture isn't all rosy. Intel's Q1 2026 guidance came in light, with revenue expected lower and earnings around break-even. Management pointed to supply constraints as the main issue—internal wafer capacity is tight, forcing them to prioritize server chips over client products. Inventory buffers are basically gone, which means more outsourcing in the short term even as foundry utilization slowly ramps up.

⬤Overall, Q4 shows Intel making real progress while still facing challenges. Margins and operating income moved sharply higher, and free cash flow turned positive at around $800 million. The foundry business remains a drag with negative margins, but the recovery is clearly being led by AI and data center strength. Whether Intel can scale capacity, execute consistently, and keep improving economics will determine how this plays out for both the company and the broader chip sector.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova