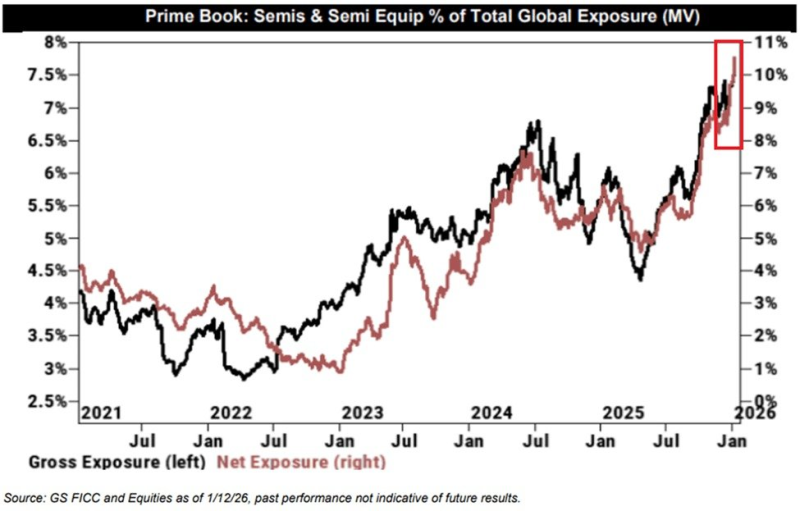

⬤ Hedge funds are going all-in on semiconductor stocks right now. The sector's grabbed 7.5% of total global hedge fund market exposure—an all-time high. This massive shift comes from two things: chip stock prices going through the roof, and institutional investors getting way more aggressive with their positions. The semiconductor sector's been crushing it performance-wise, and that's pumping up hedge fund exposure big time. Bottom line? These funds are betting heavy on the industry's long-term future.

⬤ Net exposure just hit a new record at 10.5%—that's after accounting for all the hedges. We're talking about a mind-blowing 900% jump since 2022. Hedge funds keep piling into semiconductors because institutional money's flooding in from everywhere. These players are banking on chip demand staying red-hot, fueled by tech breakthroughs across pretty much every industry you can think of.

⬤ Here's the catch though: this surge in exposure means the risks are piling up too. Sure, chip demand keeps growing across AI, automotive, and telecom sectors. But hedge funds need to watch out for market corrections, geopolitical drama, or supply chain chaos. Going this aggressive on semiconductors could bite back hard if the market hits any unexpected bumps or runs into tech roadblocks.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova