Google Cloud's recent performance shows a striking acceleration in revenue growth that reflects how deeply artificial intelligence is reshaping enterprise tech spending. The platform took over a decade to hit its first $10 billion in annual recurring revenue (ARR), but added the next $10 billion in just six months. This rapid climb signals that AI infrastructure, data services, and cloud-native tools are pushing Google Cloud into a fundamentally new phase of expansion.

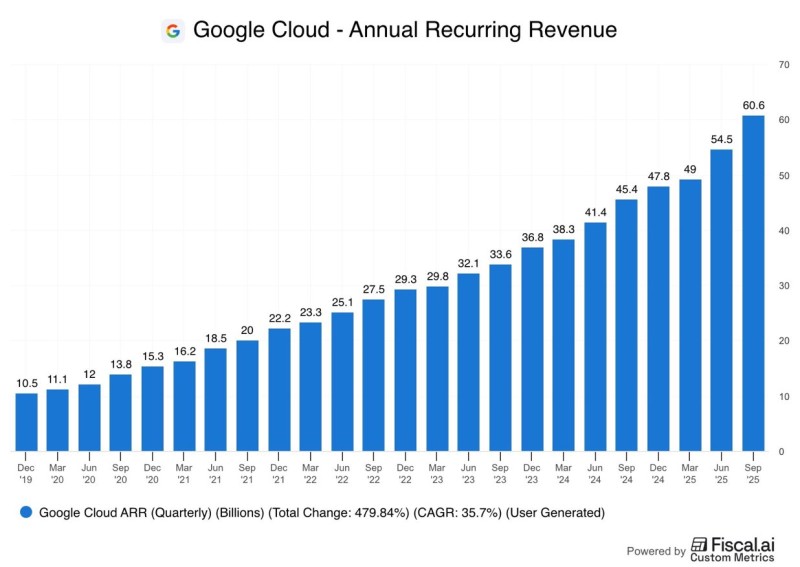

Chart Overview: Revenue Nearly Sextuples in Five Years

Market analyst Shay Boloor highlighted Google Cloud's extraordinary trajectory — climbing from $10.5 billion in December 2019 to $60.6 billion by September 2025. That's a 479.8% total increase and a 35.7% compound annual growth rate.

The curve steepens dramatically from late 2023 through 2025, when ARR jumps by nearly $22 billion, showing how adoption of generative AI and advanced machine learning has supercharged growth. This sharp rise demonstrates how Google has successfully turned its AI expertise into scalable enterprise products, from Gemini and Vertex AI to BigQuery's AI integrations and productivity tools like Duet AI.

The AI Flywheel Driving Cloud Growth

The speed of this growth reflects the compounding nature of the AI economy, where investment in AI creates new demand for compute, data, and cloud resources, which in turn drives further innovation. Google Cloud's ARR pattern is a direct example of this momentum. As enterprises adopt AI systems, they increasingly depend on Google's infrastructure for:

- Model training and inference on large datasets

- Cloud storage and computing at scale

- Integration of AI tools into everyday business workflows

AI adoption is reinforcing demand for the very platforms that power it, and Google Cloud is benefiting disproportionately from this feedback loop.

Google's Competitive Edge

Google's rapid climb signals a growing challenge to industry leaders Amazon Web Services and Microsoft Azure. While AWS remains the largest provider by absolute revenue, its growth rate has slowed compared to Google's. Azure maintains strong enterprise adoption through OpenAI partnerships, but Google's approach combining its own hardware (TPUs), AI models, and custom data centers has created a unique vertical integration advantage. The key differentiator is that Google isn't just hosting AI workloads — it's building the underlying AI foundation models and compute stack that customers demand.

Beyond Cloud: The Broader Economic Impact

Google Cloud's rise from $10 billion to $60 billion ARR in under six years reflects more than one company's success. It marks a structural shift in the global economy. AI is now driving what economists call digital capital formation, where new investment in compute infrastructure, data processing, and automation tools is becoming as essential as physical capital was in the industrial era. This growth has ripple effects across the supply chain, from chipmakers like Nvidia to power infrastructure providers, reinforcing that AI is not just a software trend but an economic transformation.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov