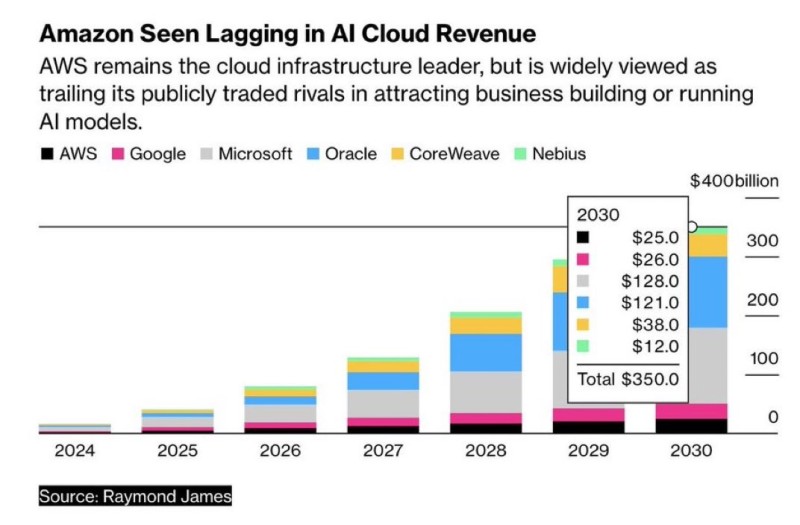

The AI cloud battle is heating up, and the competitive landscape is shifting fast. Recent projections from Raymond James reveal an uncomfortable truth for Amazon: while AWS dominates traditional cloud infrastructure, it's losing momentum in AI-focused revenue to competitors like Microsoft and Oracle. The forecast points to a major industry realignment where AI-optimized platforms could redefine cloud leadership over the next decade.

AWS Slipping in the AI Race

Raymond James estimates the AI cloud market will balloon to $350 billion by 2030. These projections, highlighted by trader Shay Boloor, show a striking reality: AWS, long considered untouchable in enterprise cloud, is predicted to capture just 7% of that massive pie.

Compare that to the competition:

- Microsoft: 37%

- Oracle: 35%

- CoreWeave: 11%

- Google Cloud: 8%

- Amazon (AWS): 7%

- Nebius: 3%

Even with AWS's deep enterprise relationships, vast infrastructure, and integration across Amazon's business empire, the analysis suggests its AI offerings aren't resonating as strongly as Microsoft's Azure AI or Oracle's enterprise systems.

What the Numbers Show

The Raymond James chart tells a striking story about diverging trajectories. By 2030, Microsoft and Oracle are forecast to rake in $128 billion and $121 billion respectively in AI cloud revenue, dwarfing AWS's projected $25 billion. Google comes in at $26 billion, CoreWeave at $38 billion, and Nebius at $12 billion. The takeaway is clear: AWS's AI growth looks sluggish compared to its overall cloud dominance. Microsoft and Oracle are aggressively pursuing enterprise AI workloads and forging partnerships with AI developers, while upstarts like CoreWeave prove that GPU-heavy infrastructure can quickly capture AI training demand—a challenge traditional cloud giants didn't see coming.

Why AWS Shouldn't Be Written Off

Despite these bearish projections, some investors think the market is sleeping on AWS's AI potential. The company still boasts the planet's largest enterprise client base, with thousands of integrations spanning virtually every industry.

If even a fraction of those customers start running AI workloads through Amazon Bedrock (their managed foundation model platform) or training models on Trainium chips (Amazon's custom AI hardware), AWS could narrow the gap faster than expected. Boloor captures this contrarian view: "I'm buying the gap between what people think Amazon is and what it's actually building—that's why Amazon is now my biggest position." It's a bet that AWS's apparent underperformance in AI forecasts makes it one of the most mispriced opportunities in cloud computing.

The $350B AI Infrastructure Boom

This projected $350 billion market represents a fundamental shift in how technology infrastructure works. AI models—from language generators to multimodal systems—demand enormous computing power, instant inference capabilities, and bulletproof data security.

Cloud providers are racing to become AI-first platforms, blending hardware, software, and data management in new ways. Microsoft leverages its OpenAI partnership and Office 365 integration, Oracle focuses on enterprise data migration and high-performance compute, Google relies on proprietary TPU technology and Vertex AI, while CoreWeave specializes in GPU clusters for AI labs and startups. AWS is taking a different approach—offering modular AI services that let enterprises customize and deploy models securely at scale.

The Road Ahead

The Raymond James forecast presents a sobering scenario where Amazon's AI cloud share shrinks to single digits even as the market explodes. But Amazon has repeatedly proven its ability to reinvent itself—from online bookstore to e-commerce giant to cloud infrastructure leader. That capacity for transformation shouldn't be underestimated. If AWS can successfully weave AI-native services like Bedrock and Trainium into its massive enterprise ecosystem, there's still time for a comeback before 2030. For now, though, the data delivers a clear message: in the AI cloud race, momentum counts as much as market share. Amazon may be the reigning cloud champion, but staying on top means moving fast—and right now, its rivals are sprinting ahead.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov