Since ChatGPT's debut in late 2022, artificial intelligence has transformed from a tech buzzword into Wall Street's biggest growth engine. But this surge comes with a catch: just 41 AI-focused companies are responsible for roughly 70% of the S&P 500's gains, while the other 459 companies lag far behind. As Twitter user Tomoyaa Sakura recently pointed out, this concentration is both impressive and worrying.

The Numbers Tell the Story

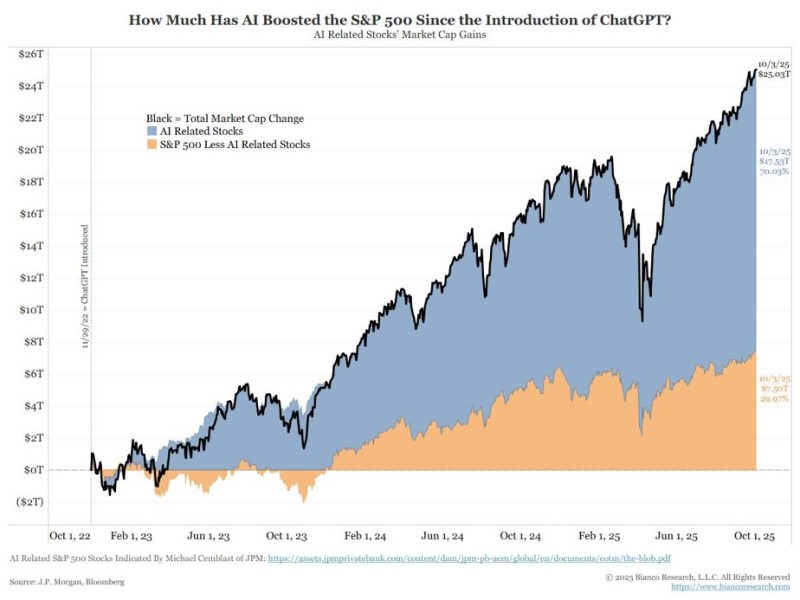

Data from J.P. Morgan and Bloomberg shows the S&P 500 has added $25 trillion in market value since late 2022. Of that, $17.5 trillion—or 70%—came from AI-related stocks. The remaining 459 companies? They contributed just $7.5 trillion combined.

What's driving this AI boom?

- Huge capital flowing into chip makers and cloud platforms

- Companies racing to adopt generative AI tools

- Investors piling into a handful of "winners" while ignoring the rest

The Risk Factor

Here's the problem: when 70% of your gains come from less than 10% of companies, you're walking a tightrope. If AI sentiment cools—whether from regulation, disappointing earnings, or tech setbacks—the whole market could stumble. It's reminiscent of the late '90s dot-com bubble, when a few tech darlings carried the market until they didn't.

The S&P 500 is supposed to be a diversified benchmark. Right now, it's anything but.

What's Next

AI isn't going anywhere. Breakthroughs in models, chips, and business applications will keep these stocks in the spotlight. But as analyst warned, a rally standing on one leg is never stable. Today's rocket fuel could become tomorrow's volatility trigger. Investors would be wise to remember that concentrated gains often precede concentrated losses.

Usman Salis

Usman Salis

Usman Salis

Usman Salis