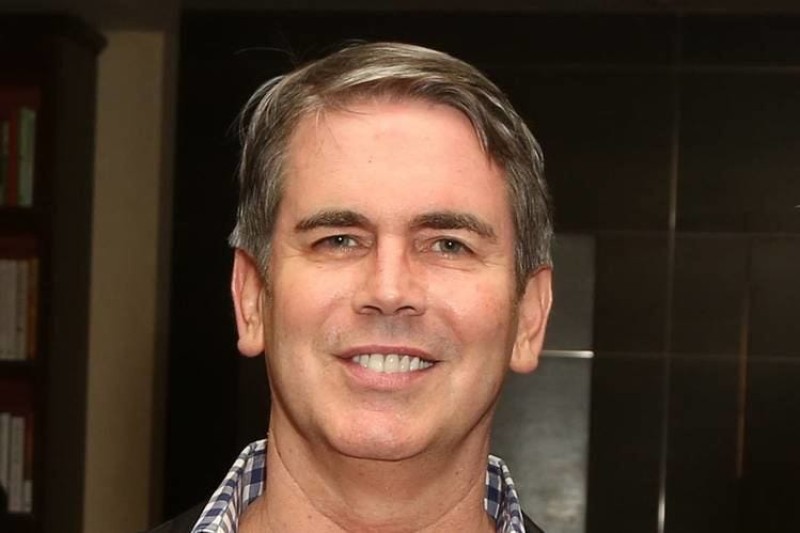

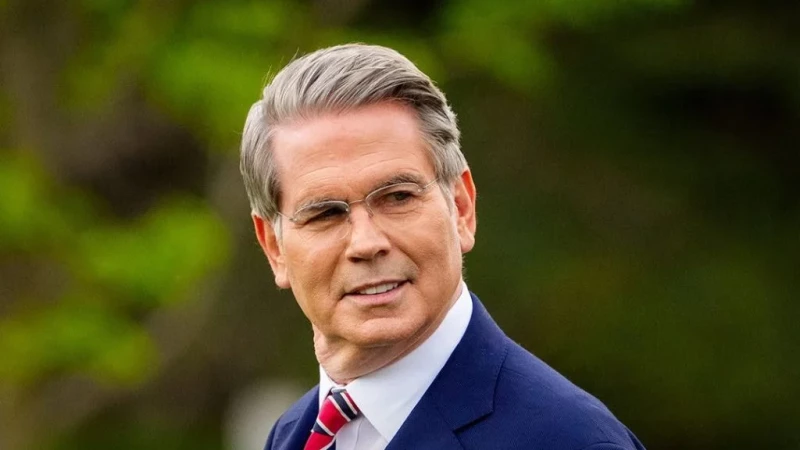

Scott Bessent's story starts the way a lot of wealthy people's stories don't—with his dad going bankrupt. When the family hit hard times in Conway, South Carolina, nine-year-old Scott didn't just watch from the sidelines. He went out and got his first job. That early taste of financial struggle lit a fire in him that never went out.

Fast forward to today, and Bessent isn't just wealthy—he's running the entire U.S. Treasury Department. His path from that first paycheck to managing billions of dollars for George Soros, and eventually building his own fortune, proves something important: where you start matters way less than what you do with every opportunity that comes your way.

Early Career: How Bessent Earned His First Paycheck

Growing up in Conway, South Carolina, Bessent watched his dad work as a real estate developer. When the business went under, nine-year-old Scott didn't wait around feeling sorry for himself—he got out there and found his first job. That early brush with financial hardship taught him lessons about risk and money that no textbook ever could.

College brought him to Yale, where he studied political science and dreamed of becoming a journalist. He worked on the Yale Daily News and went after the editor position, but didn't land it. Here's where things get interesting—instead of sulking about the rejection, he completely switched gears. At a Yale career event, he met Jim Rogers, who'd been George Soros's original business partner. That chance meeting turned into an internship that basically opened every door on Wall Street.

His first proper finance job? Brown Brothers Harriman, one of those old-school private banks that had been around forever. We're talking mid-1980s entry-level money here—probably somewhere between $40,000 and $60,000 a year. Not bad for a fresh college grad, but absolutely nothing compared to what was coming down the pipeline.

Career Development and Rising Salaries Through the Decades

After Brown Brothers Harriman, Bessent jumped to the Olayan Group in Saudi Arabia. Talk about learning how international money really moves—he got a front-row seat to high-stakes business deals that most people only read about. Then came his next big break: working at Kynikos Associates under Jim Chanos, who's basically a legend in the short-selling world. And here's the kicker—Chanos happened to be a major client of George Soros. Small world, right?

That connection got Bessent through the door at Soros Fund Management in 1991, and that's when his career absolutely exploded. By the time he was running the London office in the early 1990s, he was pulling in seven-figure salaries plus bonuses. But September 1992 changed everything. That's when Bessent helped Soros's team make one of the most famous bets in financial history—shorting the British pound on what's now called Black Wednesday. They walked away with $1 billion in profit. For a win like that, Bessent's personal cut probably jumped into the millions overnight.

The money kept rolling in through the '90s and early 2000s. In 2000, Bessent left Soros to start his own shop called Bessent Capital, managing about $1 billion. When you're running a billion-dollar fund, you're typically taking home around 2% in management fees plus 20% of whatever profits you make. Even with decent returns, that could mean $20 million or more every year.

Scott Bessent Net Worth at His Peak Performance

Bessent went back to Soros Fund Management in 2011, this time as Chief Investment Officer—basically one of the most powerful jobs in the entire hedge fund world. Two years later, he did it again. In 2013, he bet against the Japanese yen and made Soros another $1.2 billion. When you're delivering those kinds of numbers on multi-billion-dollar portfolios, you're not making chump change. Top hedge fund CIOs at that level were routinely taking home anywhere from $10 million to $30 million a year in total pay.

But here's where Bessent really leveled up. In 2015, he launched his own fund called Key Square Group, and George Soros himself kicked in $2 billion to get it started. Think about that for a second—one of the greatest investors in history trusted Bessent with $2 billion right out of the gate. That launch was one of the biggest hedge fund starts anyone had ever seen.

As founder and CEO, Bessent was positioned to capture both management fees and performance fees from billions in assets. His financial disclosures later showed he'd made about $3.8 million in salary alone over a two-year stretch—and that's not even counting bonuses or his own investment gains. The fund had some rough years in the middle, but came roaring back with strong performance in 2021, 2022, and 2023. Then in 2024, Bessent made another smart call, betting that Trump's election would boost U.S. stocks. He was right, and the fund posted double-digit returns. Those winning years probably generated tens of millions in performance fees that went straight into Bessent's pocket.

Current Financial Status: Scott Bessent Net Worth in 2025

So what's Scott Bessent net worth today? According to official paperwork filed in December 2024, he's sitting on at least $521 million. But most financial experts think it's actually higher—probably somewhere between $600 million and $700 million. And he's not just parking all that money in some boring savings account. He's spread it around smart.

Bessent's got over $100 million in Treasury bills, another $150 million in big ETF shares, and real estate worth anywhere from $10 million to $50 million scattered across the Bahamas, North Carolina, and Charleston, South Carolina. He even owns farmland in North Dakota that brings in up to $1 million a year just in rent. Plus he's collected between $1 million and $5 million worth of art and antiques, because why not?

Now that he's Treasury Secretary, Bessent makes $250,600 a year—which sounds like a lot until you realize that's probably less than he made in a single month running his hedge fund. But there's a silver lining. When you take a government job like this, you can sell off your financial holdings tax-free. Former Treasury Secretary Henry Paulson did the same thing and saved himself something like $200 million in capital gains taxes. If Bessent sold everything, he could've dodged hundreds of millions in taxes completely legally.

His real estate moves tell you everything you need to know about how he builds wealth. Back in 2016, he bought this gorgeous historic mansion in Charleston—the John Ravenel House—for $6.5 million. He fixed it up, lived in it, then listed it for $22.5 million in 2024. Eventually sold it for $18.25 million in 2025, which set a record for the area. Between 2007 and 2024, Bessent bought and sold about $127 million worth of properties across New York, Florida, and South Carolina. The guy treats real estate like both an investment and a hobby.

Success Principles: Bessent's Blueprint for Building Wealth

What really sets Bessent apart isn't just that he made a ton of money—it's how he thinks about investing and life in general. His approach offers lessons that work whether you're managing billions or just getting your 401k started.

First off, Bessent is obsessed with doing his homework. During his years with Jim Rogers and George Soros, he figured out that winning in markets isn't about gut feelings or hot tips you hear at a party. He spends months digging into macroeconomic trends, political changes, and structural market shifts before putting serious money on the line. Those massive wins betting against the British pound and Japanese yen? Those weren't lucky guesses. They were the result of exhaustive research.

Second, he's completely comfortable going against the crowd. When everybody else sees danger, Bessent looks for opportunity. That takes serious confidence, but also discipline—you need to know when to bet big and when to sit tight. He's said that avoiding "analysis paralysis" matters just as much as doing your research. Sometimes you've got to trust what you've learned and pull the trigger.

Third, Bessent plays the long game. He's not interested in day-trading or trying to beat quarterly earnings reports. His biggest scores—those currency trades worth billions—required holding positions through scary volatility and trusting his analysis even when markets moved against him at first. That kind of patience is what separates people who get rich from people who just get lucky once.

Fourth, risk management is everything to him. Watching his dad's business fail taught him early on that over-leveraging or putting too much into one bet can wipe you out completely. He's always thinking about controlling leverage, keeping cash available, and never betting so big that one bad trade destroys you. His hedge fund survived some brutal years specifically because he managed risk carefully instead of swinging for the fences every time.

Finally, Bessent spreads his money around—not just different types of investments, but different countries and strategies. His portfolio covers U.S. stocks, foreign currencies, commodities, real estate, farmland, you name it. This global approach means he's not depending on any single market or country to keep making him money.

Throughout his career, Bessent has also talked about how important relationships and mentors are. Working under George Soros and Stanley Druckenmiller for over a decade taught him more than any business school ever could. He's publicly said his mentors shaped how he thinks about investing and opened doors that sped up his whole career.

For regular people trying to build wealth, Bessent's story breaks down into pretty simple advice: invest in learning your craft, do real research before making money moves, think years ahead instead of chasing quick wins, don't risk more than you can afford to lose, spread your investments around, and learn from people who've already done what you're trying to do. None of this is rocket science—it's just discipline applied consistently over decades.

From that nine-year-old kid working his first summer job to running America's entire economic policy, Bessent's journey proves that building serious wealth isn't about flashy trades or getting lucky. It's about showing up, thinking strategically, taking smart risks, and sticking with it even when things get rough.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov