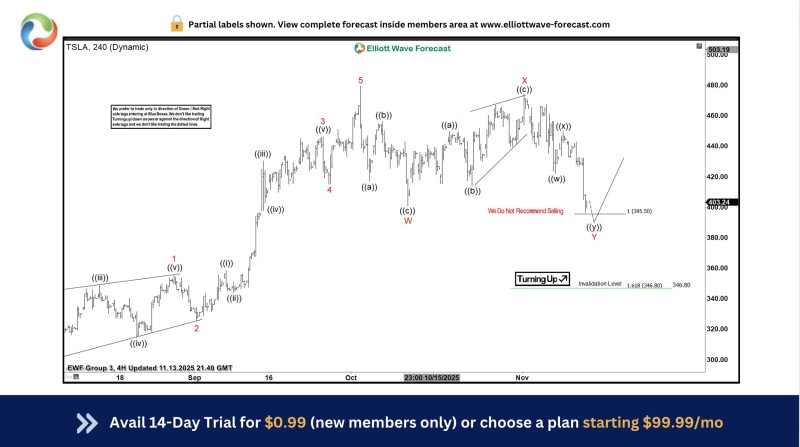

⬤ Tesla bounced back after wrapping up a double correction that started November 13, landing in the anticipated $395.90 to $346.80 zone. The pullback bottomed at $380.79, and TSLA has been climbing since then, holding steady above the November 14 low.

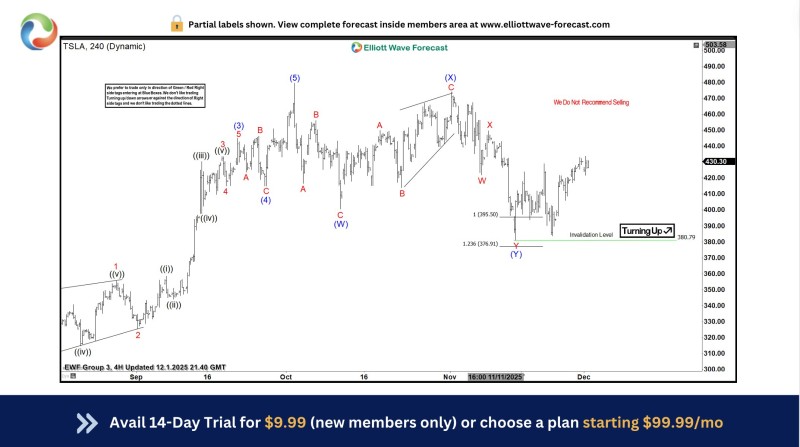

⬤ The W–X–Y pattern played out as expected, with Tesla finding support above its invalidation threshold. From the $380.79 bottom, the stock started moving upward, matching the forecast that discouraged selling at those levels. Price action is now building the first leg of the expected rally.

⬤ The Elliott Wave framework points to continuation toward the $502.6 to $540 zone, or at least a three-wave advance as long as key support holds. The technical setup shows momentum shifting after the correction wrapped up, suggesting the uptrend from November is still in play.

⬤ This matters because Tesla's price swings tend to ripple through growth and tech sectors. A sustained push toward $502.6 would confirm strengthening momentum in TSLA and could influence broader market sentiment, especially among high-beta stocks tied to cyclical demand and risk appetite.

Peter Smith

Peter Smith

Peter Smith

Peter Smith