- 1. Cuban missile crisis

- 2. Arab-Israeli war and the oil embargo

- 3. Iran hostage crisis

- 7. Atypical pneumonia (SARS) 2003

- 8. Lehman Brothers Bankruptcy

- 9. The global financial crisis or the Great Recession

- 10. Intervention in Libya in 2011

- 11. Voting for UK withdrawal from EU (Brexit)

- 12. COVID-19 – the new danger

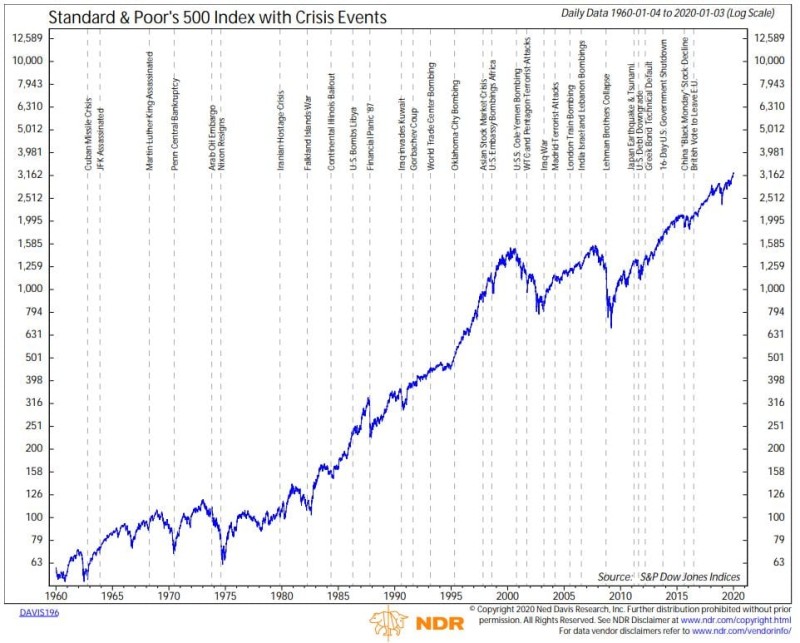

The stock market is a “litmus test paper,” which reflects the state of the world economy. Wars and catastrophes, epidemics, and political crises – there are many unpredictable events that can suddenly turn the bull market into a bear market. COVID-19 pandemic is the latest one: since February 20th, it has caused the fall of the S&P 500 index by almost 30%.

However, that’s not the only event like that. Let’s take a retrospective look at the biggest stock market collapses in history.

1. Cuban missile crisis

Collapse date: October 16, 1962

Index Drop: 7%

Recession Period: 12 days

After the end of World War II, the USA and the USSR started the arms race (which was the part of the Cold War). Meanwhile, the revolutionary government of Fidel Castro came to power on Cuba in 1959 and started introducing socialistic reforms. The Soviet Union supported the reforms and offered its help to the Cuban people. The very fact of cooperation between Cuba and the Soviet Union caused serious concern in the United States.

In 1961, the Americans created a military base in Turkey and deployed missiles with nuclear warheads in close proximity to the USSR. Nikita Khrushchev understood the consequences of such a missile strike on the USSR, so the Soviet authorities decided to deploy nuclear missiles in Cuba in response. They transferred 40 nuclear missiles and the necessary equipment to Cuba by October 14, 1962. That caused the escalation of the conflict.

The stock market was affected by the crisis: the S&P 500 index fell by 7% but managed to recover pretty quickly. Some experts say that this crisis never happened; to be precise, it did not affect the stock market. The index flattened, and it was not as dreadful as the 27% drop of the index in June 1962.

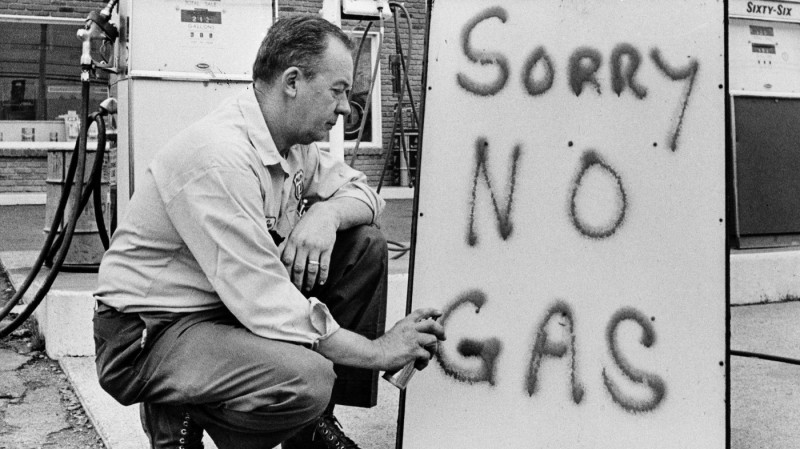

2. Arab-Israeli war and the oil embargo

Collapse date: October 29, 1973

Index Drop: 17.1%

Recession Period: 27 days

On October 6, 1973, an 18-day military conflict broke out between the coalition of Arab countries and Israel, which was called Doomsday. In the conditions of the Cold War, Syria, Egypt, Iraq, and Jordan were supported by the armed forces of the USSR, while Israel and Europe got help from the United States.

On October 17, Arab countries announced that OPEC was halting oil supplies to the United States, Japan, Europe (Great Britain, France, and Holland). The market reacted instantly: the price of oil over the next 12 months increased four times - from $ 3 to $ 12.

In North America and European countries, industrial production is reduced by 48% - strikes begin. The jump in prices for gasoline and diesel fuel, the refusal of citizens from cars, the reduction in the number of flights by almost two times affected the state of the stock markets. The capitalization of the New York Stock Exchange decreased by 45% while the London Stock Exchange Index fell by 73%.

The peak fall in stock indices occurred on October 29, 1973. The decline in the S&P 500 lasted 27 days and amounted to 17.1%. The return of the UK stock market to the pre-crisis level occurred in 1987, while the United States managed to finally overcome the consequences of the crisis only in 1993.

3. Iran hostage crisis

Collapse date: October 5, 1979

Index Drop: 10.2%

Recession Period: 24 days

Prerequisites for the next stock market crash began to take shape at the beginning of 1979. In January, the Islamic Revolution took place in Iran. Power in the country was captured by radical Shiites led by Ayatollah Khomeini. The new government has reduced oil production: now, the country began to provide only its own needs, although, before the change of government, it provided 5% of the global supply of oil.

Relations with the United States were strained: on their territory, under the pretext of treatment, the former shah had taken refuge with leukemia. As a result, on November 4, 1979, a crowd of students seized the US Embassy in Tehran and took 66 people hostage demanding the extradition of the fugitive ruler to his homeland. Later, 14 people were released, and the rest were imprisoned for 444 days.

US President Jim Carter’s responsive measures were strict. He blocked Iranian assets stored in US banks and introduced a ban on the import of Iranian oil. Economic sanctions did not solve the hostage problem, and the Eagle Claw military operation was a failure.

Soon after, the second “oil shock” started: negative expectations regarding oil supplies led to an increase in oil prices from 12–14 to $ 36–45 per barrel. The stock market immediately responded to the crisis in the national economy: the S&P 500 index fell 10.2% in 24 days. The first signs of the transition to the bull market appeared only in 51 days, but the economy recovered successfully.

4. Black Monday

Collapse date: October 13, 1987

Index Drop: 28.5%

Recession Period: 5 days

Since 1982, the US stock market has maintained a “bullish” position. Growth began to slow by 1986. The inflation rate declined, and experts unanimously reiterated that a new economic "boom" was coming. Exchange trading intensified: from January 1985 to October 1987, and the Dow Jones index grew twofold.

An unprecedented collapse began on October 13, 1987: the New York Stock Exchange Index fell by 22.6%. The peak of the recession occurred on October 19. The causes of the collapse included:

- Ineffective software trading that failed to cope with a large number of arbitrage and hedge transactions;

- ill-conceived strategies of “short deals”: borrowed securities were sold on the “bull market,” which created a liquidity shortage.

The market was overestimated by experts, and the psychology of investors played a cruel joke - the active growth of the Dow Jones index forced them to sell assets in droves. The exchange could not stand the heat, and the recession began.

The crisis spread to the Hong Kong stock exchanges (index drop - 45.8%), Canada (22.5%), Australia (41.8%), Great Britain (26.4%).

The reaction of the S&P 500 pronounced into a decrease of 28.5% in just five days. The return period from the “bear market” to the “bull” was 398 days.

5. The first Gulf War on January 1, 1991

Collapse Date: January 1, 1991

Index Drop: 5.7%

Recession Period: 6 days

The military conflict between Iraq and Kuwait is known not only for the unprecedented use of aviation but also for its influence on world stock trading. In 1988-1990, stock markets were growing steadily: indices increased over two years by an average of 50%. Oil prices were stable and kept at $20 per barrel.

In July 1990, Iraq began to draw military units to the Kuwait border. The Dow Jones and S&P 500 indices sag by 5-10%, and by the end of the year, the collapse rate reached 20%. The threat of war is becoming apparent – the growth of oil prices is predictable.

The peak of the stock market fall occurred on January 1, 1990: the S&P 500 then lost 5.7%. The recession lasted six days. The gradual return of trading to its former positions began with the launch of Operation Desert Storm on January 17. The conflict did not affect long-term stock market trends.

6. Terrorist attacks of September 11, 2001

Collapse date: September 11, 2001

Index Drop: 11.6%

Recession Period: 6 days

On September 11, a group of 19 specially trained terrorists from the al-Qaeda organization captured four passenger airliners in order to carry out the most significant terrorist attack in the history of the planet. During the operation, both buildings of the World Trade Center were destroyed. Many office buildings in Manhattan were affected.

Due to a malfunction of telecommunication equipment from September 11 to September 17, 2001, the following events happened:

- The interaction of the country's banks with the Federal Reserve System ceased, and then functioned in a limited mode;

- American Stock Exchange and NASDAQ closed;

- Although the stock market data centers were not affected, customers lost touch with the exchange, and the behavioral factor led to a 7.1% drop in the Dow Jones index and 14.3% in a week.

The value of shares on the New York Stock Exchange lost $ 1.2 trillion. Under these conditions, the S&P 500 decreased by 11.6% from September 11 to September 17. The bull market was returned in 8 days.

7. Atypical pneumonia (SARS) 2003

Collapse Date: January 14, 2003

Index Drop: 14.1%

Recession Period: 39 days

During the COVID-19 pandemic, people often recall the SARS epidemic (Severe Acute Respiratory Syndrome, SARS, SARS) that broke out in 2002 and, in 2003, had a major impact on stock markets.

SARS virus was first detected in November 2002 in the Chinese province of Guangdong. The epidemic has spread to 30 countries. Of the 8,400 cases, 813 died.

The economic consequences of the epidemic were the following:

- A 3-10% drop in the disease-affected countries due to the recession of the transport (65%) and hotel sectors (25%), a decrease in food production (15%) and a drop in the service sector (8.5%);

- Manufacturing and construction output decreased by 1.7–4.6%.

- The first to react to the situation was the Hong Kong Stock Exchange, whose shares fell in price by 8–10% back in December 2002.

The crisis, caused by a 5.8% reduction in world production and a significant influence of China on the global economy, led to a slow collapse of US stock trading at the end of 2002. By mid-January, the Dow Jones Index fell 22.1%.

The S&P 500 recession lasted more than a month and, at its peak, reached 14.1%. The fall lasted 39 days, but the market managed to regain its previous positions only in March 2003.

8. Lehman Brothers Bankruptcy

Crash Date: September 15, 2008

Index Drop: 56.8%

Recession Period: ~180 days

On September 5, 2008, Lehman Brothers, the fourth-largest investment bank in the United States, filed for bankruptcy. The collapse of one of America's oldest financial institutions with 160 years of history, without exaggeration, produced the effect of an exploding bomb. In one day, the Dow Jones stock index crashed by 500 points - such a New York stock exchange has not experienced since the terrorist attacks of September 11, 2001. Losses continued until March 5, 2009, when the Dow closed at 6,594.44. That was a 53% drop from its peak of 14,164.53 on October 10, 2007. The S&P 500 closed at 1,192.69, its lowest close in nearly three years. Within a few days, the financial crisis affected the markets of the United States, and soon after - the whole world.

On September 16, 2008, the American insurance company AIG was on the verge of bankruptcy due to the collapse of Lehman Brothers, and the US government spent $ 180 billion on the nationalization. On September 18, Lloyds (Britain) was forced to agree to a merge with the HBOS. On October 12, the new bank The Lloyds Group and at the same time Royal Bank of Scotland were nationalized. In October 2008, the US Treasury Department allocated $ 00 billion to support the banking system and the automotive industry.

In spring 2009, the new administration of Barack Obama allocated $787 billion to stimulate the economy, which went into a sharp peak after the bankruptcy of Lehman Brothers. Thanks to the active intervention of the monetary authorities of the United States, Europe, and Japan, the consequences of the bankruptcy of Lehman Brothers were able to compensate.

9. The global financial crisis or the Great Recession

Crash Date: October 10, 2008

Index Drop: 56.8%

Recession Period: 356 days

The largest drop in stock markets in the history of exchange trading is the Great Recession 2007-2009. The crisis pronounced in the following events:

- 2006 - The number of overdue mortgages in the USA begins to grow gradually, which was caused by an increase in floating interest rates on high-risk loans (subprime lending);

- 2007 - Banks started revealing the information on losses, and by the end of the year, more than 50 of them declared bankruptcy;

- 2008–2009 - The value of shares is reduced by 45–50%, and stock indices are falling by 30–60%.

Among the causes of the crisis are financial derivatives - derivative securities, yield, which depends on the magnitude of the risk. Up to 40% of investments in the financial and construction sectors came from them, which created an artificial bubble.

The financial crisis in the United States “contaminated” other countries: the collapse affected the housing, financial, and commodity markets. In October 2008, the MSCI World index (developed economies) fell by 32.2%, and the MSCI Emerging Markets index (developing economies) fell by 40.5%.

On October 10, 2008, the collapse of the Dow Jones Index in just a day was 6.6%. During the year of the crisis, the S&P 500 decreased by 56.8%. For almost three years, the US stock market has been operating in a bearish mode.

10. Intervention in Libya in 2011

Crash Date: February 18, 2011

Index Drop: 6.4%

Recession Period: 18 days

In 2011, NATO forces invaded Libyan territory under the pretext of protecting civilians in a civil war. The war in the oil-producing region of the Middle East repeated the scenario of two wars in the Persian Gulf. Oil prices rose from $ 99.7 to $ 120.9 per barrel, which was due to the complete paralysis of Libyan oil refineries and a reduction in black gold production by eight times. US government spending on a military operation was estimated at $600-800 million, and US corporation losses were more than $ 50 billion.

The fall in the markets was short-term and ended in March 2011 - even before the bombing of the country and the assassination of Gaddafi. In general terms, the recession of the S&P 500 index amounted to 6.4% and lasted 18 days. A month later, the market returned to its previous positions.

11. Voting for UK withdrawal from EU (Brexit)

Collapse Date: June 8, 2016

Index Drop: 5.6%

Recession Period: 14 days

In June 2016, 52% of the UK population expressed a desire to leave the European Union. Later, an agreement was signed that by December 31, 2020, Britain would withdraw its troops from the EU and cease to participate in its political processes. However, it will retain its place in the Customs Union and within the framework of a single market.

The transition process of the country's exit in June 2016 to the economic consequences manifested into several sequences. Over the month, the pound sterling fell by 10% against the US dollar and by 7% against the Euro. In just one day (June 5), the London Stock Exchange Index (FTSE 100) fell 3%.

A few days later, the collapse reached the exchange trading in the USA: the bear tendency started ruling the market, which resulted in a reduction of the S&P 500 by 5.6%. Nine days after, the exchange began to rise.

12. COVID-19 – the new danger

Collapse Date: February 19, 2020

Index Drop: 29.5%

Recession Period: 19 days

The current situation with coronavirus pandemic couldn’t leave stock markets unaffected. The reduction of the S&P 500 index by 29.5% took just 19 days. At the moment, the success of exchange trading is volatile: on March 13, the indicator increased by 12% but lost 2-4% per day afterward.

The reasons for the next financial crisis caused by the COVID-19 pandemic are:

- a shutdown of 70-90% of production facilities and service enterprises in countries affected by the virus;

- serious negative effects on the Chinese economy which started recovering only in mid-March 2020;

- ‘oil war’ between Russia and Saudi Arabia;

- a slowdown in world trade due to the closure of borders in more than 80 countries.

The global stock market crash started on February 19, 2020. The Dow Jones, S&P 500 and NASDAQ-100 indices lose 2-3% over the next 30 days for each daily session.

On Black Monday, March 9th, all three indicators (Dow Jones, S&P 500 and NASDAQ-100) declined in just a day by more than 7%: this recession was recognized as the most disastrous since the 2007 crisis.

Did the market hit the new lows?

The disastrous effects of the pandemic on the stock market are hard to overestimate. Here’s what happened:

- On Black Thursday (March 12), the New York Stock Exchange collapsed by 9%, while the Italian Borsa Italiana - by 17%.

- The global MSCI AC World index lost 21.7% in the quarter, which was the worst result since the fourth quarter of 2008 (-22.77%).

- The most significant drop during the same period was experienced by the American S&P 500 and Japanese Nikkei (-20% each).

- For the Stoxx Europe Index, this quarter was the worst since 2002, when the technology bubble was finishing to deflate.

- The Dow Jones Industrial Average and the British FTSE 100 hadn’t experienced such a fall since 1987 when the Black Monday took place in October.

- For the Australian S & P / ASX 200, this period is the worst in its entire history.

The dynamics of the VIX index showed that this time the market participants were even more scared than in 2008. In mid-March, the VIX soared to its peak in 2008, and its quarterly growth by 289% was the most significant since 1990 for which data are available.

Given the global adverse socio-economic impact of COVID-19, it is too early to talk about the revival of the bull market trends. For some economies, it will take months or even years to recover.

The current state of the stock market causes panic among investors. Trading expert Warren Buffett recommends players to focus on the long term profits: volatility is temporary, the bull trend will be restored, and patient investors will be rewarded. The above-mentioned stories of crises prove that. For some, the fall of stock quotes for someone means ruin and collapse, while for others, it provides the opportunity to buy shares of large, profitable, and stable companies cheaply.

Peter Smith

Peter Smith

Peter Smith

Peter Smith