- Tesla (TSLA) Receives Rare Upgrade Despite Market Hesitation

- TD Cowen Analyst Boosts Tesla (TSLA) Rating and Price Target

- Tesla (TSLA) Faces Significant Headwinds Amid Long-Term Potential

- Wedbush Doubles Down on Tesla (TSLA) Despite Recent Selloff

- Tesla (TSLA) Receives Mixed Analyst Coverage Despite Upgrade

Tesla shares struggle to maintain momentum even as Wall Street voices remain optimistic about the EV maker's long-term potential.

Tesla (TSLA) Receives Rare Upgrade Despite Market Hesitation

Tesla (TSLA) stock experienced significant volatility on Friday, spending much of the trading session in negative territory despite receiving a notable upgrade and strong endorsement from a historically bullish analyst. The electric vehicle manufacturer's shares initially rose a few dollars from Thursday's close, trading above $266, but those gains quickly evaporated as the stock dropped to as low as $250.73 during the session, completely erasing its post-election rally.

By late trading, Tesla (TSLA) managed to eke out a minimal 0.1% gain, closing at $263.47, while broader market indices like the S&P 500 and Dow Jones Industrial Average advanced 0.4%.

TD Cowen Analyst Boosts Tesla (TSLA) Rating and Price Target

In what should have been a significant catalyst for the stock, TD Cowen analyst Itay Michaeli upgraded Tesla shares from Hold to Buy late Thursday, dramatically increasing his price target from $180 to $388 per share. This $208 jump in target price comes with some context - Michaeli recently transferred from Citi, where he had maintained a Hold rating on Tesla with a price target of $258. At TD Cowen, he replaced previous analyst Jeff Osborne.

"There are merits to both the bull and bear cases," Michaeli wrote in his analysis. "While there is no shortage of challenges this year... the list of potential game-changing level catalysts across EV, autonomous vehicles, and robotics are robust enough to tilt risk/reward favorably."

Tesla (TSLA) Faces Significant Headwinds Amid Long-Term Potential

Tesla currently faces several substantial challenges that have contributed to investor anxiety. These include the potential elimination of federal EV purchase tax credits worth up to $7,500, President Donald Trump's import tariffs that increase Tesla's parts costs, and intensifying competition in the electric vehicle market.

However, Michaeli emphasized several potential catalysts that could drive Tesla's growth in the coming years. These include a new lower-priced electric vehicle expected to launch around mid-year, the anticipated rollout of a self-driving robotaxi business by year-end, and Tesla's humanoid robotics business planned for expansion in 2026.

Wedbush Doubles Down on Tesla (TSLA) Despite Recent Selloff

Adding to the positive Wall Street sentiment, Wedbush analyst Dan Ives placed Tesla stock on his firm's "best ideas" list as a "table pounder" - signifying strong conviction in the investment. "This is a gut check moment for the Tesla bulls (including ourselves) after this massive selloff in Tesla shares with fears mounting," Ives noted.

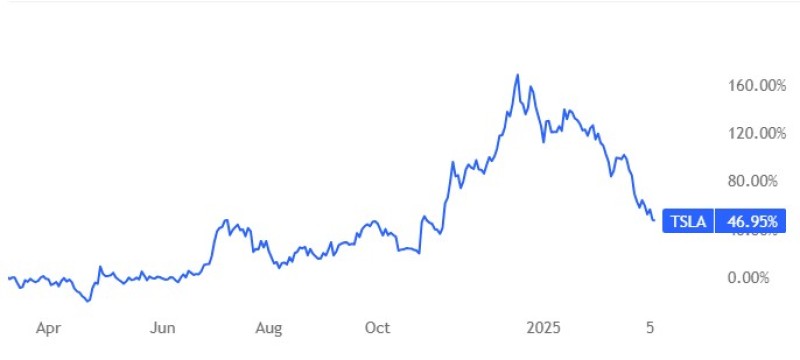

Tesla stock has experienced a dramatic decline, falling approximately 46% from its all-time intraday high of $488.54 reached on December 18. The stock had initially surged around $237 following the November 5 election, as investors anticipated benefits from CEO Elon Musk's close relationship with President Trump. However, more recently, concerns have grown that Musk's political activities could be negatively impacting Tesla sales.

"While the DOGE/Trump Musk iron clad partnership has created major brand worries for Tesla... we estimate less than 5% of Tesla sales globally are at risk from these issues," Ives continued. "We expect Musk will better balance his time between DOGE and Tesla/SpaceX over the course of 2025." Wedbush maintained its Buy rating and $550 price target on the stock.

Tesla (TSLA) Receives Mixed Analyst Coverage Despite Upgrade

Following Michaeli's upgrade, approximately 49% of analysts covering Tesla now rate the shares as a Buy, according to FactSet data. This remains slightly below the average Buy-rating ratio for stocks in the S&P 500, which stands at about 55%. The average analyst price target for Tesla stock is approximately $379 per share.

Tesla's volatile performance comes at a critical juncture for the company as it navigates political uncertainties, increased competition, and shifts in consumer sentiment toward electric vehicles. While analyst confidence appears to be strengthening, the market remains cautious about Tesla's ability to overcome these immediate challenges while pursuing its ambitious long-term vision for autonomous driving and robotics.

Usman Salis

Usman Salis

Usman Salis

Usman Salis