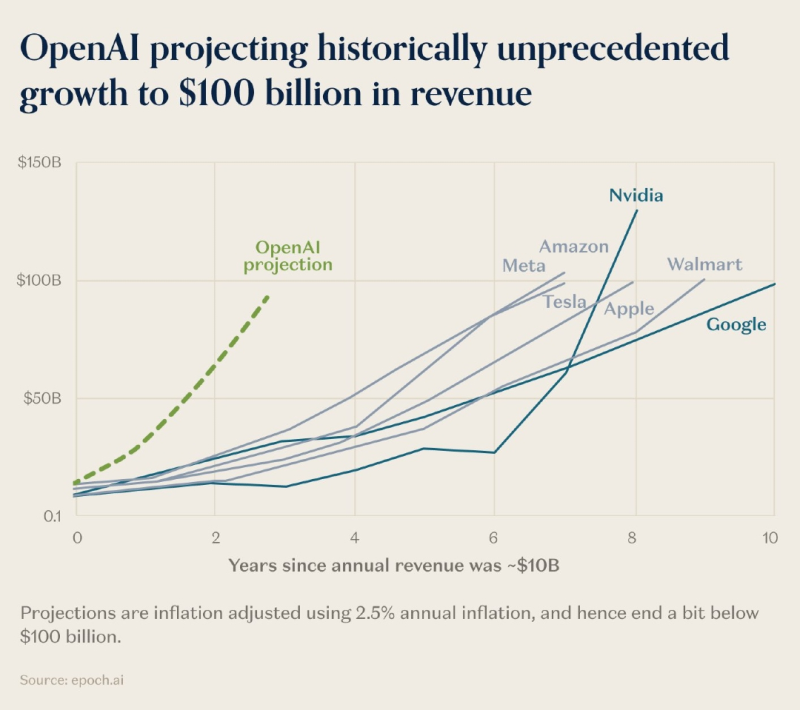

● A recent tweet from Stock Sharks dropped an eye-opening stat: OpenAI is forecasting it'll hit $100 billion in annual revenue at a pace no tech company has ever matched. Using data from epoch.ai, the comparison stacks OpenAI against household names like Google, Apple, Tesla, Nvidia, Amazon, Meta, and Walmart — and OpenAI's trajectory leaves them all in the dust.

● The chart shows something pretty wild. OpenAI just crossed $10 billion in annual revenue, and it could potentially reach $100 billion in roughly five years. For context, Google and Apple took about a decade to climb that same mountain. This breakneck speed isn't just hype — it reflects genuine, explosive demand for AI tools, enterprise APIs, and custom model integrations as generative AI becomes essential infrastructure across basically every industry.

● But here's the catch: growth this fast comes with serious baggage. To actually pull this off, OpenAI has to juggle skyrocketing compute costs, massive data center investments, and fierce competition from players like Anthropic, Google DeepMind, and Meta. Then there's the looming specter of regulatory scrutiny around AI safety and usage. Analysts are already warning that while revenue might shoot through the roof, profit margins could take a hit unless OpenAI gets smart about hardware efficiency and licensing deals.

● If OpenAI does hit that $100 billion mark, it would instantly join the ranks of the world's biggest corporations — potentially going toe-to-toe with Nvidia and Google in raw revenue. The company's game plan includes scaling up enterprise subscriptions, licensing out its API infrastructure, and pushing AI assistants into sectors like healthcare, education, and finance. These moves could democratize AI access globally while offsetting the brutal long-term costs of developing cutting-edge models.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah