Nvidia has been the poster child of the AI revolution, turning early believers into millionaires and making "diamond hands" a badge of honor. But as the company prepares to report earnings, cracks are starting to show in what seemed like an unstoppable rally. The stock that could do no wrong is suddenly looking very human.

NVDA Price Faces Resistance Before Earnings

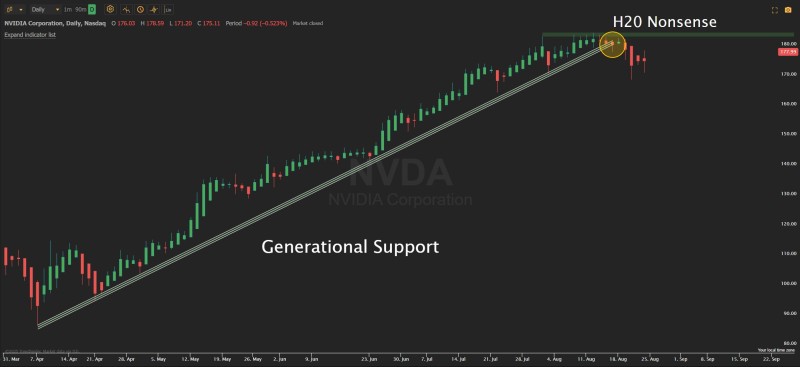

The magic is wearing off, at least for now. After months of defying gravity, Nvidia is bumping its head against a ceiling that's proving surprisingly stubborn. The stock tried to punch through $178.59 but got smacked down, closing at $175.11 with a modest 0.52% decline that somehow feels more significant than the numbers suggest.

What's catching traders' attention isn't just the failed breakout—it's the way it failed. The buying enthusiasm that used to sweep away any resistance is noticeably absent. It's like watching a championship boxer who's lost a step: still dangerous, but no longer invincible.

Trader @JPATrades put it perfectly: "$NVDA looks toppy heading into earnings. There I said it. Will delete if wrong." That kind of raw honesty from a respected voice tells you everything about the mood right now. Even the bulls are getting nervous.

Generational Support Holds the Trend

Here's the thing keeping bulls from panicking: that beautiful support line that's been Nvidia's safety net since spring is still intact. Every time the stock has tested it, buyers have stepped in like clockwork. It's been the foundation of this incredible run, and it's not showing signs of cracking yet.

But here's what's worrying: we're seeing a classic case of an unstoppable force meeting an immovable object. The $180 level has become a brick wall, and volume is drying up just when the stock needs firepower to break through. If earnings disappoint, that drop to $165-$170 could happen faster than anyone expects.

What's Next for NVDA Price?

This is where it gets interesting. Nvidia's earnings aren't just another quarterly report—they're a referendum on the entire AI boom. The company has been the undisputed king of the AI chip world, but being king means you have the biggest target on your back.

The bulls make a compelling case: data centers are hungry for AI chips, and Nvidia is the only game in town for the high-end stuff. But the bears have a point too—when a stock is priced for perfection, even great news can feel like a disappointment.

Usman Salis

Usman Salis

Usman Salis

Usman Salis