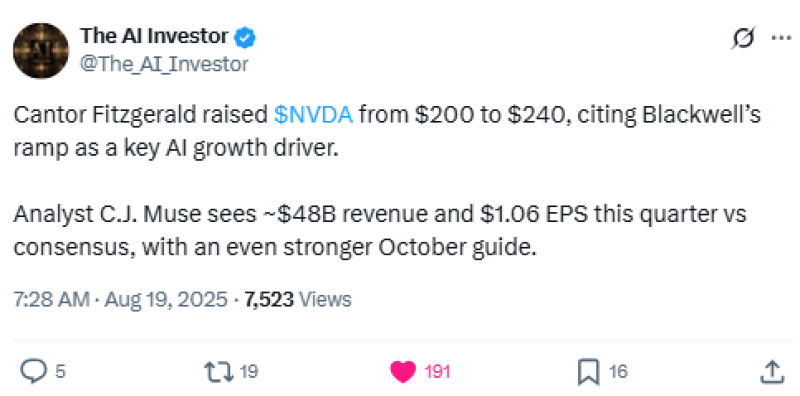

Nvidia's remarkable AI story just got another vote of confidence from Wall Street. Cantor Fitzgerald analysts have bumped their price target for NVDA shares from $200 to $240, betting big on the company's upcoming Blackwell GPU launch. With AI demand showing no signs of slowing down, this upgrade signals that Nvidia's dominance in the chip space might have more room to run.

Blackwell Chips Drive the Optimism

The heart of Cantor's bullish case centers on Nvidia's Blackwell processors. Analyst C.J. Muse sees these next-generation chips as a game-changer that'll keep Nvidia ahead of the pack in high-performance computing. As more companies race to build AI capabilities, Blackwell could be the key that unlocks Nvidia's next growth phase.

The timing couldn't be better. Cloud giants, enterprises, and data centers are all scrambling for more computing power, and Nvidia's latest chips promise to deliver exactly what they need.

Revenue Projections Beat Street Estimates

Cantor isn't just optimistic about the stock price – they're also more bullish on Nvidia's financials than most analysts. Muse forecasts around $48 billion in quarterly revenue with $1.06 earnings per share, both topping Wall Street's consensus estimates.

Even more intriguing, the firm expects Nvidia's October guidance to surprise on the upside, potentially setting up another strong rally for the stock.

What Investors Should Know

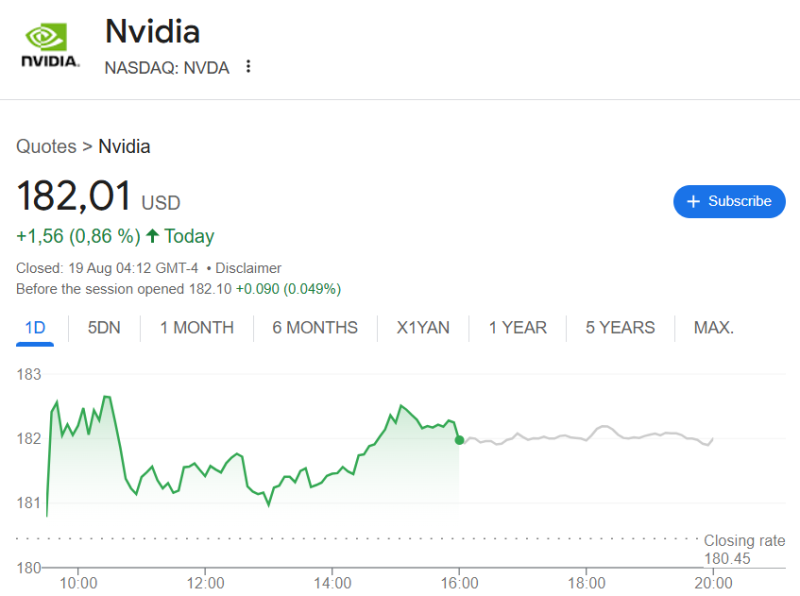

This price target bump reflects growing confidence that Nvidia's AI momentum isn't slowing down anytime soon. While the stock has already hit impressive heights, Cantor's analysis suggests there's still upside potential.

Of course, risks remain. Competition in the GPU space is heating up, and supply chain hiccups could throw a wrench in the works. But for now, Nvidia's position at the center of the AI revolution looks pretty solid.

Peter Smith

Peter Smith

Peter Smith

Peter Smith