NVIDIA (NVDA) has placed a $1 billion bet on Nokia, acquiring 166.4 million shares at $6.01 each. This move goes beyond capital—it's about fusing GPU-powered AI with global 5G infrastructure to build networks capable of handling tomorrow's data demands. The partnership signals a shift where computing and communications become deeply interconnected systems.

A New Alliance Bridging AI and 5G Connectivity

According to trader unusual_whales, the collaboration focuses on AI-driven telecom innovation. NVIDIA brings GPU leadership and machine learning expertise, while Nokia contributes networking experience and 5G deployment reach.

Together, they're building intelligent networks for autonomous vehicles, massive IoT systems, and real-time machine communication.

This represents a fundamental infrastructure shift—where AI actively manages data flow across networks in real time, making smart connectivity critical to economic competitiveness.

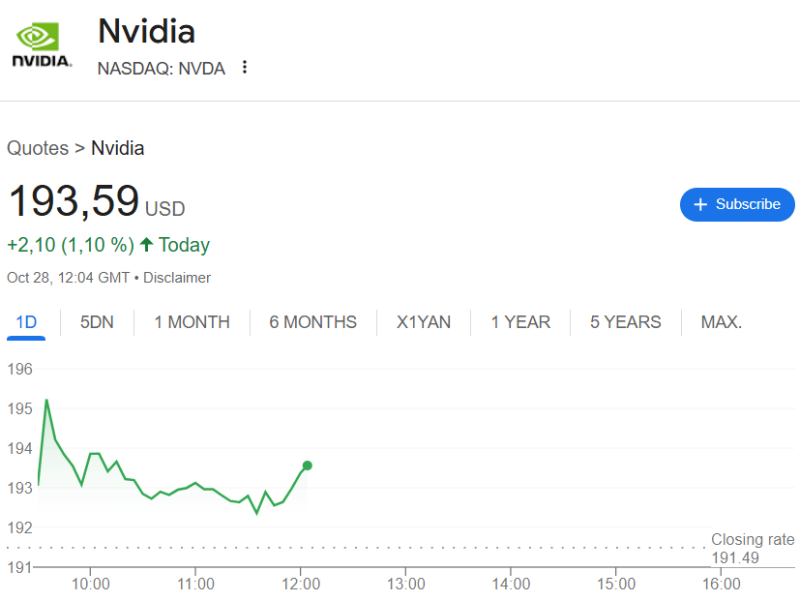

Chart Analysis: Nokia Stock Gains Momentum

Nokia's stock surged past $5.80 resistance with strong volume, breaking weeks of consolidation. The key zone ahead is $6.00–$6.10, aligning with NVIDIA's entry price—a psychological threshold that could become either resistance or a new foundation. If momentum holds, $5.50 may serve as support, targeting $6.50–$6.75 medium-term.

Strategic Implications for Both Companies

NVIDIA is expanding beyond data centers into the infrastructure connecting AI systems globally. Embedding its technology in telecom networks positions NVIDIA as essential to data flow, extending reach into edge computing where 5G meets real-world AI applications. For Nokia, the deal brings capital and access to NVIDIA's AI ecosystem—enabling network automation, predictive maintenance, and resource optimization. This helps Nokia compete against Ericsson and Huawei by offering intelligence built into networks, not just connectivity.

Market Outlook: AI-Telecom Synergy Taking Shape

Key factors driving bullish sentiment:

- Growing demand for AI-optimized network infrastructure

- New revenue streams through joint solutions

- Competitive positioning in AI and telecom sectors

- Long-term tailwinds from 5G and edge computing

Investors view this as a structural growth story targeting the intersection of AI workloads and network management. Success depends on integration speed and enterprise adoption at scale.

Peter Smith

Peter Smith

Peter Smith

Peter Smith