- NIO Achieves Impressive Q1 Delivery Milestone Despite Market Headwinds

- NIO Launches Premium ET9 Model in Strategic Market Positioning

- NIO Stock Performance Contradicts Delivery Success

- NIO Faces Profitability Challenges Despite Sales Growth

- NIO Implements Strategic Initiatives to Address Profitability Issues

- NIO Continues Multi-Brand Strategy Amid Market Challenges

Chinese EV giant NIO delivered 42,094 vehicles in Q1 2025, showing robust 40.1% year-over-year growth despite its stock trading at historic lows near 0.8 times price-to-sales ratio.

NIO Achieves Impressive Q1 Delivery Milestone Despite Market Headwinds

NIO Inc., a prominent player in the global smart electric vehicle market, has announced strong delivery figures for the first quarter of 2025. The company delivered a total of 42,094 vehicles during this period, representing a significant 40.1% increase compared to the same quarter last year. This growth comes despite challenging market conditions that have seen NIO's stock price struggle considerably.

March proved to be a particularly productive month for the Chinese EV manufacturer, with deliveries reaching 15,039 vehicles - a 26.7% year-over-year increase. These March deliveries were distributed across NIO's premium brand (10,219 vehicles) and its family-oriented ONVO line (4,820 vehicles), showcasing the company's multi-brand strategy in action.

The latest figures bring NIO's cumulative deliveries to an impressive 713,658 vehicles, underscoring the company's growing footprint in the competitive electric vehicle landscape. This milestone reflects NIO's continued ability to attract customers despite intense competition in the EV sector, particularly in China.

NIO Launches Premium ET9 Model in Strategic Market Positioning

Among the highlights of NIO's March deliveries was the introduction of its new ET9 model. The company began delivering this smart electric executive flagship in late March 2025, positioning it as their premium offering with cutting-edge technological features.

According to NIO, the ET9 represents "the epitome of NIO's full-stack technologies and industry-leading innovations." The company claims this model establishes a new benchmark for executive smart electric vehicles, potentially helping NIO differentiate itself in the increasingly crowded premium EV segment.

The launch of the ET9 aligns with NIO's strategy of expanding its product portfolio to cater to different market segments while maintaining its reputation for technological innovation. This product diversification approach could be crucial for NIO's long-term competitiveness in both domestic and international markets.

NIO Stock Performance Contradicts Delivery Success

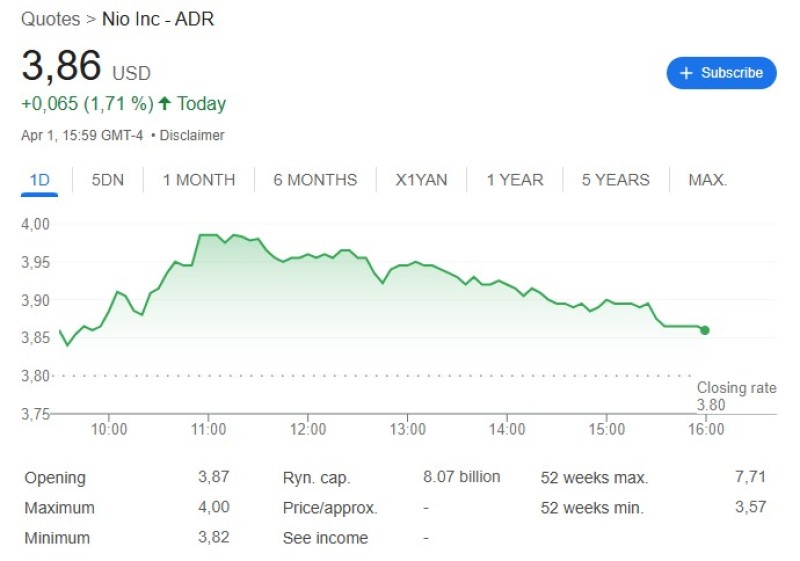

Despite the encouraging delivery numbers, NIO's stock performance has been deeply disappointing for investors. The shares have plummeted approximately 41% over the past six months, creating a stark contrast between operational growth and market valuation.

The stock is currently trading near its 52-week lows. At present prices, NIO stock is valued at just 0.8 times price-to-sales (P/S) ratio, significantly below its five-year average P/S of 2.5. This historically low valuation suggests either severe market pessimism or potential undervaluation of the company.

Following the announcement of Q1 delivery figures, NIO shares saw a modest 1.57% increase in premarket trading on Tuesday. However, this minor gain does little to offset the recent downward trajectory that has seen the stock decline nearly 10% over the past week and 14.7% over the last month, substantially underperforming the broader S&P 500 index.

NIO Faces Profitability Challenges Despite Sales Growth

The disconnect between NIO's delivery growth and stock performance can be largely attributed to the company's financial results. Despite increasing vehicle sales by 13% year-over-year in Q4 2024, NIO's net loss surged by 33% during the same period, raising concerns about its path to profitability.

For the full year 2024, NIO reported a concerning 8% increase in net losses, reaching $3 billion on revenue of $9 billion. These persistent financial struggles continue to worry investors despite the company's impressive sales momentum and growing market presence.

Several factors have contributed to NIO's profitability challenges in recent quarters. Intense price competition in the Chinese EV market has forced the company to implement multiple price reductions over the past couple of years, putting pressure on margins despite increasing sales volumes.

Additional strains on profitability include necessary car platform upgrades, elevated input costs, substantial marketing expenses, and various non-operating items. These factors have collectively had a significant negative impact on NIO's bottom line, overshadowing its delivery success.

NIO Implements Strategic Initiatives to Address Profitability Issues

NIO's management team is actively working to address these financial challenges through various cost-cutting and strategic initiatives. The company has developed and launched its own autonomous driving chip and software, aiming to reduce costs and decrease dependence on third-party suppliers.

The company is also expanding its market reach within China through its mass-market brand ONVO, with plans to introduce a second model under this brand in the coming months. This multi-brand approach allows NIO to target different price segments of the market while leveraging shared technology platforms.

NIO's Chinese competitors have also reported strong delivery numbers for the first quarter of 2025. XPENG delivered 33,205 Smart EVs in March alone, an impressive 268% increase from the previous year, with a Q1 total of 94,008 units, representing a remarkable 331% year-over-year growth.

Similarly, Li Auto reported Q1 deliveries of 92,864 vehicles, showing a 15.5% increase compared to the same period in 2024. In market activity following these announcements, XPENG shares rose more than 4% in premarket trading, while Li Auto gained 1.4%, both outperforming NIO's modest gains.

NIO Continues Multi-Brand Strategy Amid Market Challenges

NIO Inc. was established in November 2014 with the ambitious mission of "Blue Sky Coming." The company has positioned itself as a user-centric enterprise focused on innovative technology and superior customer experience in the electric vehicle sector.

Currently, NIO produces premium smart electric vehicles under three distinct brands to target different market segments: premium smart electric vehicles under the NIO brand, family-oriented smart electric vehicles through the ONVO brand, and small smart high-end electric cars with the FIREFLY brand.

This diversified brand portfolio strategy allows NIO to compete across multiple price points and customer segments, potentially providing more avenues for growth despite the challenging market conditions and intense competition in both domestic and international EV markets.

As NIO continues to expand its delivery numbers and product lineup, investors will be closely watching whether the company can translate its operational growth into improved financial performance. The stark disconnect between delivery growth and stock performance suggests that market participants remain skeptical about NIO's ability to achieve profitability in the near term, despite its impressive sales momentum.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah