- NIO (NIO) Stock Climbs on Factory Automation Push

- Robotic Quality Inspectors Boost NIO (NIO) Manufacturing Capabilities

- NIO (NIO) Embraces Advanced Humanoid Robot Technology

- Wall Street Maintains Mixed Outlook on NIO (NIO) Stock

- Financial Metrics and Institutional Investment in NIO (NIO)

- NIO (NIO) Business Operations and Market Position

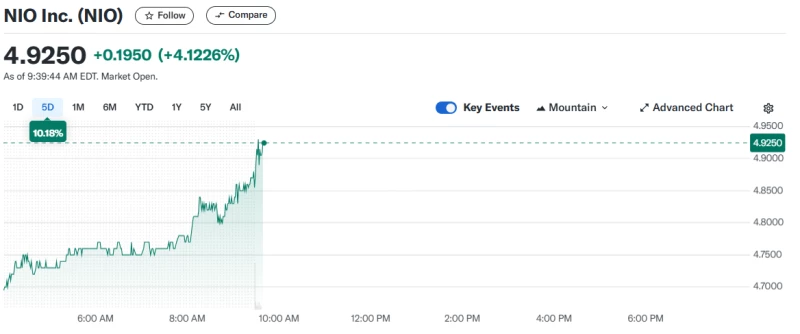

Chinese EV manufacturer NIO sees shares jump 9.9% following expansion of automation capabilities with robotic quality inspectors at its Hefei factory.

NIO (NIO) Stock Climbs on Factory Automation Push

NIO Inc. shares experienced a significant surge in recent trading, jumping nearly 10% as the Chinese electric vehicle manufacturer continues to advance its automation efforts at production facilities. The company's stock rose 9.9% during mid-day trading on Tuesday, with shares trading as high as $4.97 before settling at $4.90. This represented a notable increase from the previous close of $4.46, while trading volume reached 50,873,836 shares, slightly below the average session volume of 54,351,028 shares.

Robotic Quality Inspectors Boost NIO (NIO) Manufacturing Capabilities

The price movement comes as NIO expands automation capabilities at its F2 factory in Hefei, China. The company's founder and CEO William Li announced the introduction of robotic quality inspectors in a recent Weibo post. Li shared animated images showing robotic arms performing various inspection tasks, including tool plugging, camera photography, equipment examination, and removal processes.

NIO operates two factories in Hefei's Anhui province. The F2 facility, located at NeoPark in Xinqiao, is the company's newest plant. The automation push extends beyond manufacturing lines, with NIO's co-founder and President Qin Lihong announcing in June 2024 that a third plant is under construction.

NIO (NIO) Embraces Advanced Humanoid Robot Technology

NIO has also explored advanced manufacturing methods including humanoid robots. In 2023, UBTech Robotics introduced its Walker S humanoid robot for NIO's production line. The Walker S robot performs quality control tasks such as examining door locks, seat belts, and headlamp covers. It also affixes car emblems using real-time image capture and transmission technology.

More recently, China Star Market reported that Kuavo, a humanoid robot built by Leju Robotics and powered by Huawei's HarmonyOS, was being tested at NIO's facilities. The robot uses Pangu, a large artificial intelligence model, further demonstrating NIO's commitment to cutting-edge manufacturing technologies.

Wall Street Maintains Mixed Outlook on NIO (NIO) Stock

Despite the recent price surge, Wall Street analysts maintain mixed opinions on NIO stock. The company currently has an average rating of "Hold" and a consensus price target of $5.30. Several analysts have recently adjusted their ratings, with HSBC downgrading NIO from a "strong-buy" to a "hold" rating in January.

JPMorgan Chase lowered shares from an "overweight" to a "neutral" rating in February, reducing their target price from $7.00 to $4.70. Goldman Sachs took a more bearish stance, downgrading NIO from "neutral" to "sell" in November and decreasing their price target from $4.80 to $3.90.

Overall, two analysts rate the stock as "sell," eight as "hold," one as "buy," and one as "strong buy," reflecting the divided sentiment about NIO's future prospects.

Financial Metrics and Institutional Investment in NIO (NIO)

NIO has a market capitalization of $9.89 billion, with a price-to-earnings ratio of -3.14 and a beta of 1.81. The stock's 50-day moving average price is $4.37, while the 200-day moving average is $4.82. The company maintains a debt-to-equity ratio of 0.98, a quick ratio of 0.93, and a current ratio of 1.04.

Institutional investors have recently modified their holdings in the company. FMR LLC grew its position by acquiring 5,394,895 shares valued at $36,038,000 in the third quarter. Trexquant Investment LP invested $3,305,000 in the fourth quarter, while SG Americas Securities increased its position by 104.8% in the fourth quarter, now holding 1,151,011 shares worth $5,018,000.

Quadrature Capital raised its holdings to 2,209,020 shares valued at $14,756,000 in the third quarter. Currently, institutional investors and hedge funds own 48.55% of the stock, indicating significant professional interest in NIO's future performance.

NIO (NIO) Business Operations and Market Position

NIO designs, manufactures, and sells electric vehicles in the People's Republic of China. Beyond vehicle production, the company also manufactures e-powertrains, battery packs, and various components essential to electric vehicle manufacturing.

The company's continued investment in automation technology comes at a critical time for the Chinese EV market, which faces increasing competition both domestically and internationally. NIO's focus on advanced manufacturing processes, including the integration of robotics and artificial intelligence, may provide competitive advantages as the company works to strengthen its market position and improve production efficiency.

Peter Smith

Peter Smith

Peter Smith

Peter Smith