MicroStrategy's stock has seen impressive gains of nearly 2,500% since adopting Bitcoin as a treasury reserve asset, significantly outperforming major tech companies, including Nvidia despite recent market turbulence.

MicroStrategy Showcases Extraordinary Bitcoin Standard Era Returns

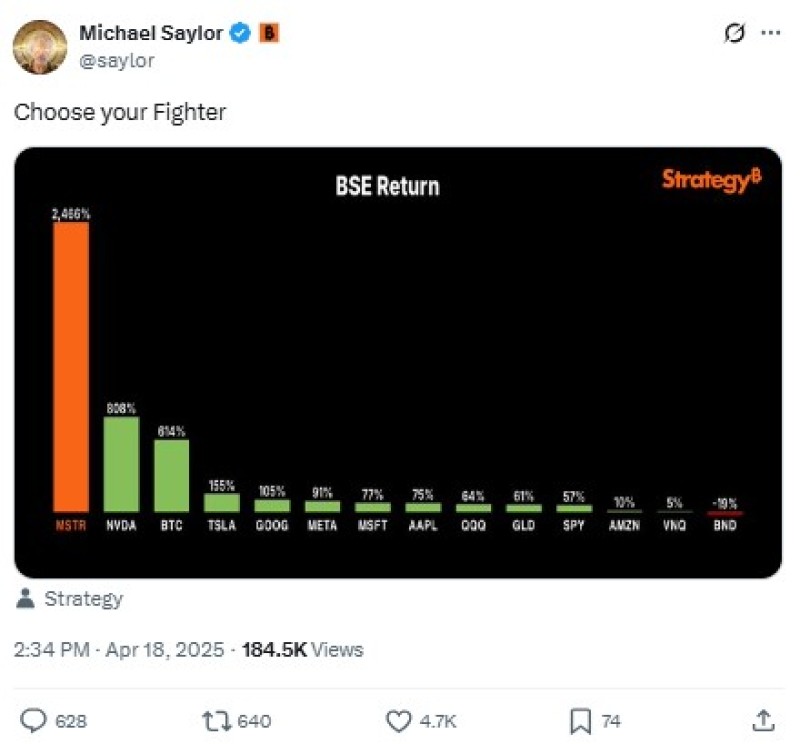

MicroStrategy's Michael Saylor has taken to social media to highlight the company's remarkable performance since implementing its Bitcoin strategy. Since August 2020, when the company first adopted Bitcoin as its treasury reserve asset, MSTR stock has skyrocketed by nearly 2,500% in what are known as the returns of the Bitcoin Standard Era (BSE).

This growth significantly outpaces even the most successful tech companies. For comparison, shares of Nvidia (NVDA), which recently claimed the title of most valuable company globally amid the artificial intelligence boom, have increased by "only" 808% during the same period. Meanwhile, Bitcoin itself has surged 614% since MicroStrategy began its purchasing strategy. Electric vehicle manufacturer Tesla (TSLA), which also holds Bitcoin on its balance sheet, has gained a comparatively modest 155% over this timeframe.

MicroStrategy Outperforms Despite Market Turbulence

MicroStrategy's year-to-date returns currently stand at 11.4%, which may appear modest compared to its long-term performance. However, this still represents an outperformance against the Nasdaq-100 index, challenging the narrative that MSTR is merely functioning as a high-beta tech stock that amplifies market movements.

Additionally, the company's continued Bitcoin purchases help support Bitcoin's price, which has demonstrated relative stability despite recent global market turbulence triggered by tariff concerns. This resilience suggests that MicroStrategy's strategy may be contributing to Bitcoin's overall market strength, providing a foundation for the cryptocurrency during uncertain economic conditions.

MicroStrategy Faces Criticism Despite Performance

Despite the impressive returns, MicroStrategy's Bitcoin-focused approach has attracted significant criticism from various financial commentators who view it as an unsustainable gamble rather than a sound business strategy. Critics argue that Saylor's aggressive Bitcoin acquisition approach represents excessive risk-taking that could eventually lead to substantial losses.

Peter Schiff facetiously suggested that the company (formerly known as MicroStrategy) should update its name to simply "Micro," predicting that the stock would eventually collapse alongside Bitcoin. Meanwhile, American entrepreneur Jason Calacanis has argued that MicroStrategy's strategy could potentially "break" the Bitcoin ecosystem by contributing to centralization of ownership.

The long-term sustainability of MicroStrategy's Bitcoin bet will ultimately depend on two critical factors: Bitcoin's future price performance and the company's ability to maintain a premium to Net Asset Value (NAV). Should Bitcoin experience a prolonged downturn, MSTR stock could face significant challenges despite its historic outperformance.

MicroStrategy Continues Innovative Funding Approaches

Undeterred by critics, Saylor continues to develop novel securities structures to secure additional funding for Bitcoin purchases. This innovative approach to corporate finance has allowed MicroStrategy to continually expand its Bitcoin holdings despite already having substantial exposure to the cryptocurrency.

For investors seeking even higher risk and potential reward than MSTR stock itself offers, several ETFs have emerged that promise to double the performance of MicroStrategy's stock. These leveraged investment vehicles amplify both the gains and losses of the already volatile MSTR stock, providing options for those looking to increase their speculative exposure to Bitcoin through traditional financial markets.

As MicroStrategy continues its Bitcoin-focused strategy, market observers remain divided on whether this approach represents brilliant foresight or excessive risk-taking. However, the performance numbers to date have undeniably favored Saylor's vision, with returns that have outpaced even the most successful technology companies during one of the strongest bull markets in modern history.

Usman Salis

Usman Salis

Usman Salis

Usman Salis