Intel (INTC) latest quarterly report marks a significant step in its turnaround effort. The semiconductor giant posted $13.7 billion in net revenue, up 3% year-over-year, beating analyst expectations by roughly $600 million. Non-GAAP earnings per share came in at $0.23, surpassing forecasts by $0.22. The company also reported a net profit of $4.3 billion, boosted by a $5.2 billion gain from the Altera transaction and Mobileye stake sale. This marks Intel's most profitable quarter since before the pandemic.

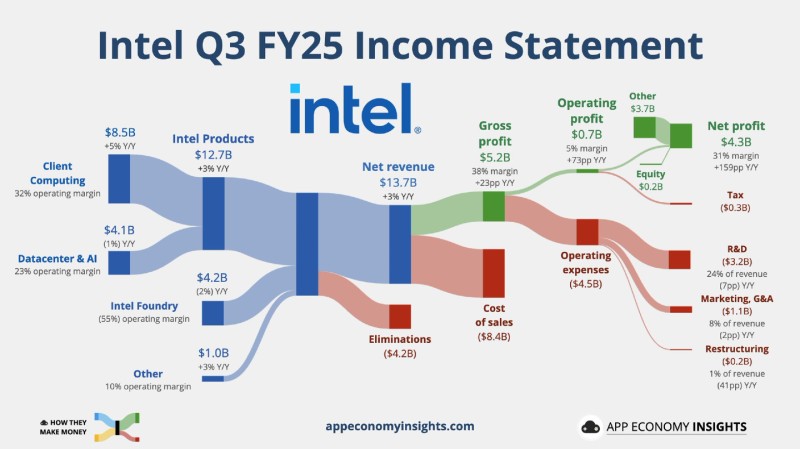

According to a recent update shared by a Stock Sharks trader, Intel's Q3 results showcase clear operational improvements. The Client Computing Group generated $8.5 billion, up 5% year-over-year, with a strong 32% operating margin. The Datacenter & AI Group brought in $4.1 billion with a solid 23% operating margin. Intel Foundry contributed $4.2 billion with an impressive 55% operating margin, demonstrating efficiency gains in manufacturing services.

Gross profit rose to $5.2 billion, representing a 38% margin, up 23 percentage points year-over-year. Operating profit stood at $0.7 billion with a 5% margin. Net profit reached $4.3 billion, translating to a 31% margin, up 159 percentage points year-over-year. Operating expenses totaled $4.5 billion, including $3.2 billion in R&D, underscoring Intel's effort to streamline operations while investing in innovation.

Outlook and Strategic Direction

For Q4 FY25, Intel expects revenue around $13.3 billion and non-GAAP earnings per share of $0.08, in line with analyst forecasts. The company is ramping up production for AI and edge computing chips, expanding capacity for external customers, and reinforcing its position in both PC and data center markets.

Usman Salis

Usman Salis

Usman Salis

Usman Salis